Donald Trump Jr. just urged Americans to take action now! He says, “My father's administration is exploring a powerful economic tool that…”Read his full message here

Ad by Birch Gold Group

🐳 Whale’s Watch: Trouble on the Horizon

Good day, dear reader - Whale Investor here.

Elon Musk has issued yet another profound economic warning, cautioning that the second half of 2025 could bring a deeper crisis than a standard market correction. This message, voiced by one of the world’s most influential entrepreneurs, carries more gravity than headline-grabbing soundbites; it reflects observant monitoring of macroeconomic fault lines forming beneath the surface of the U.S. economy. While much of the public remains absorbed in political theater and short-term market moves, discerning insiders are quietly preparing for volatility and repositioning capital toward value-preserving assets. The question now is, what does Musk’s warning mean in historical context, and how should investors respond?

The Warning Beneath the Headlines

Musk’s concerns center on a convergence of inflation pressures, escalating trade tariffs, global retaliations, and structural vulnerabilities within the U.S. market system. His pointed critique of increased tariffs hints at the risks these levies pose to growth and corporate profitability—risks that reverberate through supply chains and consumer prices alike. The specter of recession is no longer distant; it could manifest as early as the latter half of this year. Similar economic shocks have marked past cycles—post-1970s inflation spirals and the trade tensions of 2018 both disrupted market confidence and required recalibration.

Fiscal expansion and debt monetization intensify these risks. The government’s heavy borrowing to sustain stimulus and spending programs, combined with Federal Reserve policies aimed at supporting growth, sow the seeds of inflation persistence. Elevated debt levels limit policy flexibility and amplify the danger of stagflation—a toxic mix of high inflation and slowing growth.

As Musk lays bare what many financial professionals quietly sense, the tide is turning. This isn’t just conjecture; it’s an articulation of a shift in global capital flows and risk appetite.

IN PARTNERSHIP WITH

Elon Musk has made bold predictions before — and he’s rarely wrong.

This time, his warning isn’t about AI, Mars, or tech monopolies.

It’s about the U.S. economy — and why he believes the second half of 2025 could bring something far worse than a correction.

That’s what Musk posted, publicly calling out what many insiders have whispered for months.

The problem isn’t just tariffs.

What follows won’t be gradual — higher prices, global pushback, and a financial chain reaction with real consequences for everyday Americans.

And while the headlines focus on politics, those with something to lose are already moving.

They’re shifting their savings away from politically vulnerable assets — and into strategies designed to withstand economic shocks.

Not stocks.

Not tech.

Not government-backed bonds.

They’re turning to stores of value that don’t depend on Washington, Wall Street, or the Fed.

Fortunately, a special IRS rule — quietly extended under the Trump administration — still allows everyday Americans to reposition part of their retirement savings into these protected channels.

But that window won’t stay open forever. Once the next wave hits, options may tighten fast.

👉 Download the Free 2025 Wealth Protection Guide to discover how this IRS rule works — and how to move your savings before it’s too late.

The Institutional Repositioning

Far from panic-driven, the institutional response is strategic and anticipatory. Central banks worldwide are ramping up gold purchases, bolstering reserves as a hedge against currency debasement and geopolitical risk. Sovereign wealth funds and large pension plans are rebalancing, increasing exposure to hard assets such as metals, commodities, and inflation-protected infrastructure. These moves reflect a broader realignment from paper-based assets and growth-focused equities to value preservation and income reliability.

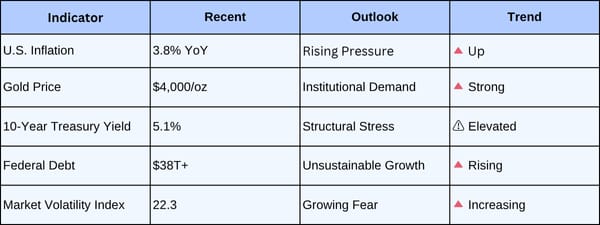

Data confirms this trend: gold prices maintain strong upward momentum amid surging institutional demand, 10-year Treasury yields sit elevated reflecting structural stress, and federal debt breaches unsustainable thresholds. Meanwhile, market volatility, as measured by the VIX, signals rising investor unease—a natural byproduct of late-cycle uncertainty.

This repositioning matters profoundly. Institutional capital moves the market currents before retail investors recognize the shift. It is a quiet but powerful dynamic, underscoring the value of depth over speed and foresight over reaction.

🌊 Whale’s Fact Break

Blue whales possess the remarkable ability to hold their breath for over 90 minutes—proof that survival in the deep, pressured waters of the ocean depends not on rapid bursts but on steady endurance. Capital deployed with patience and discipline similarly weathers the most turbulent cycles.

Data Snapshot 📊

|

Top Picks

🏦 Over 100 U.S. banks have quietly signed on to the new rules. Your IRA, Bank Account, and Savings Can Now Be Frozen Without Warning. - ad by Priority Gold

📺 The Video Musk Showed Trump — Now You Can See It - ad by Behind The Markets

💳 0% APR Cards Just Dropped. Pay Off Debt—Without Paying Interest - ad by Finance Buzz

🧠 BREAKING: Musk’s DOGE Stimulus Goes to the Smartest Americans - ad by American Hartford Gold

Swap Without MEV

Protect your swaps from MEV. CoW Swap stops bots from jumping your order, reducing slippage and failed transactions. Keep more of what you trade with execution you can trust. Trade smarter.

🐳 Whale’s Final Word

Musk’s warning is not a call to panic but to prepare. The next economic cycle will favor those who navigate with calm, disciplined foresight rather than chasing transient trends. Filtering out political noise and focusing on preserving purchasing power is paramount. The ocean currents are shifting, and only those anchored in resilient, value-preserving assets will glide smoothly as tides turn.

Swim resilient,

- Whale Investor 🐳