🐳 Whale’s Watch: The Digital Dollar’s Hidden Current

Good day, dear reader - Whale Investor here.

Something historic is unfolding quietly in plain sight: the FedNow system. To the casual eye, it may appear as nothing more than a faster payment network—instantaneous transfers available 24/7, announced with promises of convenience and efficiency. But those attuned to the deeper currents beneath our financial system understand that FedNow is far more significant. It forms the foundational infrastructure for what will become a fully programmable, centralized Digital Dollar—a system where control supersedes convenience, and financial freedom becomes conditional. This is not a warning but a briefing for those invested in safeguarding autonomy amid evolving monetary tides.

FedNow is the infrastructure phase of the U.S. Central Bank Digital Currency (CBDC) journey. By enabling instant payments between financial institutions of all sizes, around the clock, it modernizes the payment landscape much like China's digital yuan or the European digital euro projects. Yet under Washington’s polished narrative of “efficiency” and “innovation” lies an architecture designed to impose programmable rules on money itself—rules that can govern, pause, or even revoke transactions digitally.

As former President Trump insightfully framed it, FedNow acts as a Trojan Horse in the financial system—a seemingly benign upgrade masking a shift toward pervasive surveillance and centralized control. Programmable money could redefine the very notion of ownership: every transaction becomes visible instantly; every account could, in theory, be frozen by policy rather than law.

When cash disappears, privacy goes with it. What remains is permission—not true freedom.

Ad by Reagan Gold Group

Something historic is happening in plain sight. And most Americans don’t even realize it.

FedNow isn’t just a payment system. It’s the dry run for a future where cash no longer exists—where every move you make with your money is monitored, approved, or blocked by Washington.

Trump has called it out for what it is: a Trojan Horse for the Digital Dollar.

Once this system is fully rolled out, nothing about your finances will be private. Your savings, your retirement, your everyday transactions—all visible, all traceable, all controllable.

But there’s still time to prepare.

You can legally move part of your nest egg into a form of shielding that stands outside of FedNow, the Digital Dollar, and whatever comes next.

Reagan Gold Group has created a free guide that reveals exactly how to do it—and why waiting could be the costliest mistake you’ll ever make.

Claim your free guide now.

Strategic Depth: The Whale’s View

This systemic pivot is part of a historical rhythm familiar to seasoned capital: the financial resets from the collapse of the Gold Standard in 1971 to Bretton Woods’ realignment. Each era’s monetary architecture shifted how wealth is stored, transferred, and protected. Today’s FedNow is the plumbing for tomorrow’s monetary reset, establishing programmable dollars as the default unit.

The principle of monetary optionality is paramount: ownership of assets that stand outside the fiat framework becomes a form of resilience. Physical gold remains the oldest, most resilient form of non-digital sovereignty precisely because it cannot be coded, revoked, or surveilled. It is a tangible claim on value no central authority can unilaterally alter.

Positioning before systemic pivots is critical. Historically, capital flows toward independence when control tightens—seen in surges of gold ownership, offshore banking, and alternative currencies during prior monetary contractions.

When the surface glitters with speed and ease, always ask who controls the current beneath.

🌊 Whale’s Fact Break

The humpback whale can migrate over 5,000 miles across open oceans — guided not by landmarks, but by magnetic fields. True investors do the same: navigating unseen forces long before the crowd senses direction.

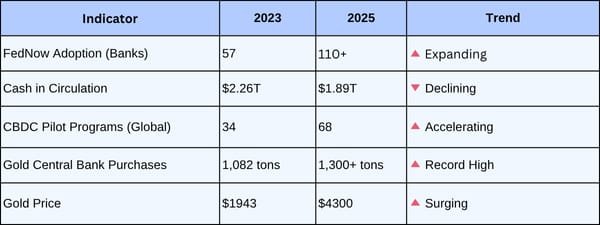

Data Snapshot 📊

|

Survey

Your opinion matters. Click here to take part in our short Whale’s Investing survey — it only takes a minute but helps chart the course for better insights ahead.🌊

Top Picks

🏦 Over 100 U.S. banks have quietly signed on to the new rules. Your IRA, Bank Account, and Savings Can Now Be Frozen Without Warning. - ad by Priority Gold

📺 The Video Musk Showed Trump — Now You Can See It - ad by Behind The Markets

💳 0% APR Cards Just Dropped. Pay Off Debt—Without Paying Interest - ad by Finance Buzz

🧠 BREAKING: Musk’s DOGE Stimulus Goes to the Smartest Americans - ad by American Hartford Gold

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

🐳 Whale’s Final Word

Technology itself remains neutral; what shifts is control. The real transformation is not digital speed but digital dependency. Affluent investors and pension holders must stay aware, adaptive, and protected. Holding something tangible and enduring, like physical gold, is a measured strategy to preserve sovereignty as this new programmable dollar current sweeps through the financial system.

Swim sovereign,

- Whale Investor 🐳