Ad by Finance Buzz

Drowning in credit card interest?

These top 0% intro APR cards can give you up to 21 months with no interest—so every dollar goes toward paying off your balance, not your bank’s profits.

No gimmicks. Just smart credit.

Click to see which cards you qualify for.

But don’t wait—these offers can vanish fast.

🐳 Whale’s Warning: The 1970s Are Whispering Again - Can You Hear It?

Good day, dear reader - Whale Investor here.

A Warning Beneath the Calm

The economic texture of the early 1970s was marked by rising prices, oil shocks, geopolitical tensions, and an eroding trust in the stability of the dollar. Inflation quietly eroded the wealth of savers caught off guard while a decade that began with optimism ended in a profound monetary reset. Half a century later, the echoes of that turbulent era are returning. Though the numbers have changed, the underlying current feels strikingly familiar. History may not repeat, but it rhymes — and today’s financial environment carries the same warning signs that demand careful attention.

Then and Now: The Inflation Mirror

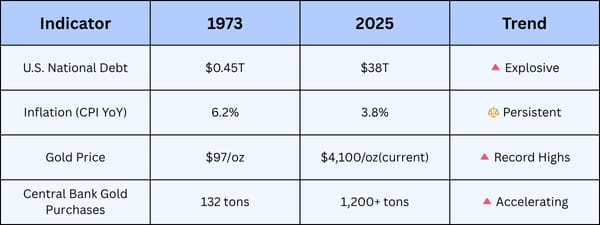

The parallels between 1970–1974 and today’s 2024–2025 landscape run deep and telling. In the early 1970s, government debt surged as fiscal deficits grew, setting the stage for inflationary pressures. Today, that debt has exploded from roughly $0.45 trillion then to over $38 trillion, weighing heavily on economic stability. Geopolitics drove energy disruptions with OPEC’s oil embargoes then; now tensions in the Middle East and shifting global energy dynamics create similarly volatile undercurrents. Policymakers then wrestled with fighting inflation without triggering recession — a dilemma echoed today as central banks navigate rate hikes amid growth fears. Nixon’s closure of the gold window ushered in fiat currency regimes; today, debates over the digital dollar signify a new chapter in monetary trust and control.

These parallels are no mere coincidence. They reflect structural cycles where debt outpaces growth and currencies are debased to maintain solvency. Each generation asks: what holds real value as paper promises weaken?

The Quiet Confirmation: Dalio’s Warning

This cycle is not theoretical. Ray Dalio — who witnessed the 1970s inflation battle firsthand — confirms that we face a late-stage debt supercycle with persistent inflation and eroding currency confidence. Dalio notes, “What’s happening right now feels a lot like the early 1970s.” His insight underscores that fiscal deficits and political fragmentation limit policy tools, while global institutions diversify reserves away from the dollar. Gold purchases by central banks are reaching record highs, signaling a rotation toward assets outside the fiat framework. Past cycles show that waiting for mainstream acknowledgment means missing the early, quieter capital shifts underway.

Ad by Cedar Gold Group

Something unusual just happened on Wall Street — and almost nobody’s paying attention.

Ray Dalio – one of the most respected investors alive – made a quiet but chilling statement this week.

No bold headlines. No wild predictions. Just a calm warning…

“What’s happening right now feels a lot like the early 1970s.”

At first glance, it might not sound alarming…but smart Americans are taking advantage of one piece of advice…

If you remember what followed the 1970s — runaway inflation, collapsing currency values, and skyrocketing commodity prices — you understand why Dalio’s words sent a shiver through seasoned investors.

He’s seen this movie before.

And this time, he says the ending could be worse.

Because unlike the 1970s…

Today, our national debt is almost $38 trillion.

Our currency is weakening at home and abroad.

And the government’s only solution seems to be printing more money.

Behind closed doors, major institutions are already repositioning.

Central banks are hoarding hard assets at record levels.

Even billionaire investors are quietly moving wealth out of traditional markets — into something tangible, something proven.

They’re not waiting for headlines.

They’re preparing now.

If you have a 401(k), IRA, or TSP, you have the same option they do — a simple, IRS-approved process that allows you to move part of your retirement savings into physical gold without paying a cent in taxes or penalties.

That’s why we created the Wealth Protection Guide — a free resource that reveals:

The real meaning behind Ray Dalio’s warning (and what it signals for the U.S. economy)

Why today mirrors the early 1970s more than most people realize

How to protect your savings with physical gold — 100% tax- and penalty-free

Click here to claim your FREE Wealth Protection Guide now.

You don’t need to be a billionaire to act on the same insights the world’s smartest investors already are.

But you do need to move before the cycle completes — because once confidence in the dollar cracks, it happens fast.

P.S. When Ray Dalio speaks, the markets listen — eventually. But by the time the headlines catch up, it’s often too late to act.

Reserve your Wealth Protection Guide TODAY — before the rest of America wakes up.

How the Smart Money Moves

This moment is materializing in subtle but powerful ways. Central banks globally dramatically expand gold reserves, reflecting hedging against currency debasement. Pension funds and sovereign wealth managers increase allocations to hard assets, protecting real purchasing power against inflation’s stealth. Even tech billionaires shift part of their wealth into tangible stores of value, recognizing the limits of paper currencies and digital-only portfolios. This repositioning is not reactionary panic but strategic depth — capital moving quietly beneath the visible surface, anchoring wealth for the storms ahead.

The lesson for individual investors is clear: you have access to similar protective mechanisms through modern retirement accounts that allow tax- and penalty-free allocations into physical gold and other hard assets. This democratization of institutional-grade protection is timely and critical.

🌊 Whale’s Fact Break

The sperm whale can dive to depths where water pressure is over 100 times that at the surface—a world of calm beneath turbulence. In finance, protection lies away from noise, in the patient depth where real wealth endures.

Data Snapshot 📊

|

Top Picks

🏦 Over 100 U.S. banks have quietly signed on to the new rules. Your IRA, Bank Account, and Savings Can Now Be Frozen Without Warning. - ad by Priority Gold

📺 The Video Musk Showed Trump — Now You Can See It - ad by Behind The Markets

💳 0% APR Cards Just Dropped. Pay Off Debt—Without Paying Interest - ad by Finance Buzz

🧠 BREAKING: Musk’s DOGE Stimulus Goes to the Smartest Americans - ad by American Hartford Gold

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

🐳 Whale’s Final Word

Markets don’t repeat history; they rhyme with it. Dalio’s measured tone is born not of alarm but hard-earned experience. Those who prepare ahead of headlines, who anchor capital before panic sweeps in, preserve not only wealth but confidence—the true currency of freedom.

To navigate these currents, strategic calm and deliberate action are your greatest assets.

Swim prepared,

- Whale Investor 🐳