🐳 Whale’s Signal: The Tide Before the Altcoin Surge

Good day, dear reader - Whale Investor here.

Bitcoin ETFs once seemed a distant rumor until institutional inflows shattered expectations—surging past $37 billion and redefining crypto’s market credibility. Now, altcoins stand at a similar threshold. Yet most retail investors remain skeptical or distracted, while seasoned institutional desks quietly prepare for a wave of pending altcoin ETF approvals that could redraw the crypto landscape far beyond Bitcoin’s prior surge. From my seat, here’s what’s forming beneath the surface — and how to strategically position before the tide turns.

The Market Undercurrent

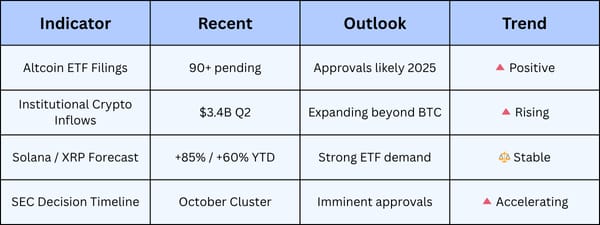

The macro undercurrent driving altcoin ETFs is shifting decisively. Following Bitcoin ETF’s breakthrough, the SEC’s posture toward altcoins has softened significantly. Bloomberg analysts now estimate 90–95% odds for altcoin ETF approvals this fall, a stark contrast to previous regulatory hesitance. This shift means liquidity flows previously focused almost exclusively on Bitcoin are primed to rotate into top-cap altcoins with pending ETF applications—such as Solana, XRP, Litecoin, and Dogecoin—once approvals go live.

Further fueling this momentum is an institutional psychology of “pre-positioning.” Large desks and asset managers accumulate altcoins ahead of regulatory green lights to secure optimal entry points before the public markets react. This behavior mimics historic patterns seen during Bitcoin ETF buildup, where institutional accumulation foreshadowed rapid valuation spikes. With multiple ETF decision deadlines clustered through October and November, the stage is set for a broad institutional rotation across the crypto sector.

Every tide that lifted Bitcoin began as a ripple few noticed. This one’s no different.

Ad by Boardwalk Flock

Remember when Bitcoin ETFs were just a rumor?

Then they got approved, and over $37 billion poured in within months, pushing Bitcoin to new all-time highs.

Now it's altcoins' turn.

Over 90 altcoin ETF applications are currently pending with the SEC, and Bloomberg analysts are giving 90-95% approval odds for major altcoins like Solana, XRP, and Litecoin in 2025.

This isn't just speculation anymore.

The SEC is expected to streamline altcoin ETF approvals, with decisions coming soon.

When these approvals hit, we're looking at:

Billions in institutional money flowing into altcoins

Mainstream adoption acceleration

Price discovery perhaps unlike anything we've seen

But here's the critical part:

The biggest gains get locked-in BEFORE the ETFs launch, not after. Smart money is positioning now, while most investors are still waiting for "confirmation."

With final decision deadlines clustering around October, the next few weeks could be your last chance to position before the announcements.

My "Crypto Bull Run Millionaire Blueprint" breaks down exactly how to find altcoins to buy at low prices right now, when to buy them, and how to position for maximum gains when the approvals hit.

The altcoin ETF wave is coming.

The question is: will you ride it or watch from the sidelines?

Beyond the Headlines: The Whale’s View

The altcoin ETF surge is not merely about hype or speculative frenzy—it signals a fundamental shift in institutional adoption. The playing field now demands that altcoins meet stringent regulatory standards, offering custody, compliance, and transparency—features that once differentiated enterprise-grade assets from retail-focused tokens. This institutional legitimacy creates an S-curve effect: once regulation legitimizes altcoins, capital inflows compound exponentially, catalyzing broader market acceptance and innovation.

Timing remains as critical as asset selection. The difference between generational returns and missed opportunity hinges on entering before institutional footprints become visible in market prices. Historical parallels abound—the gold’s revaluation in the 1970s and early tech ETF booms both emerged from prolonged phases of regulatory clarity preceding explosive capital inflows.

In this evolving cycle, most investors wait for headlines to confirm what the deep money already suspects. Strategic patience, data-driven positioning, and a long-term horizon distinguish enduring winners from transient participants.

🌊 Whale’s Fact Break

A blue whale’s heart beats just once every 10 seconds — slow, steady, and perfectly attuned to the ocean’s rhythm. True investors operate the same way: in sync with cycles, not noise.

Data Snapshot 📊

|

Survey

Your opinion matters. Click here to take part in our short Whale’s Investing survey — it only takes a minute but helps chart the course for better insights ahead.🌊

Top Picks

🏦 Over 100 U.S. banks have quietly signed on to the new rules. Your IRA, Bank Account, and Savings Can Now Be Frozen Without Warning. - ad by Priority Gold

📺 The Video Musk Showed Trump — Now You Can See It - ad by Behind The Markets

💳 0% APR Cards Just Dropped. Pay Off Debt—Without Paying Interest - ad by Finance Buzz

🧠 BREAKING: Musk’s DOGE Stimulus Goes to the Smartest Americans - ad by American Hartford Gold

Best Price, Every Trade.

Want the best price on every swap? CoW Swap evaluates routes across DEXs in real time and settles the most efficient path. Tighter pricing, higher success rates, fewer reverts. Find your best price.

🐳 Whale’s Final Word

Institutional change always appears quiet before it echoes loudly across markets. The surface may seem still, but potent undercurrents are already shaping altcoin trajectories. Those who learn to sense and align with these deep flows early are the ones who thrive amid disruption.

Patience, positioning, and perspective—these remain the investor’s trident in turbulent times, guiding calm navigation beneath shifting tides.

Swim strategic,

- Whale Investor 🐳