🐳 Whale’s Patriot Wealth Signal — Beat the Tax Swamp at Its Own Game

Good day, dear reader - Whale Investor here.

The undertow beneath American prosperity grows stronger with each passing year. Many feel the sting of working harder while their net savings steadily erode, an invisible current pulling value away beneath the surface. Politicians speak of growth and opportunity, yet their words ring hollow amid a quiet drain of wealth that few openly acknowledge. Behind the scenes, Washington’s policies and the elite’s tax maneuvers form two sides of the same imbalance, shifting power and assets upward while the middle class struggles to stay afloat. This dynamic, long ignored by mainstream discourse, demands attention to understand—and resistance to outsmart.

Five Defining Challenges Dragging Down Wealth

1. The Hidden Tax Spiral

Inflation acts like a stealth tax, working invisibly to increase your effective tax burden each year. As prices rise, so do nominal wages—sometimes—but these increments rarely keep pace with inflation’s true cost. Meanwhile, tax brackets fail to adjust fully, leaving taxpayers effectively pushed into higher brackets or losing deductions. Currency decay quietly swells your tax payments while reducing the value of what remains in your account. This invisible spiral gradually siphons wealth without direct legislative action, a subtle undertow dragging millions off course.

2. The Washington Wealth Shield

In stark contrast, lawmakers and their connected inner circles exploit intricate legal loopholes unavailable to most citizens. From offshore accounts to sophisticated trusts and tax-protected vehicles, elite wealth isn’t just preserved — it often grows tax-free for generations. These shields turn tax law into a fortress, accessible only to those with resources and counsel to navigate it. Meanwhile, the average taxpayer bears the bulk of the burden, locked out of these protections despite paying the rising costs.

3. The Retirement Erosion Effect

Traditional IRAs and 401(k)s—cornerstones of retirement planning—offer an illusion of security. They provide tax deferral, yes, but your “savings” are ultimately government IOUs, subject to future taxation that can be unpredictable and heavy. Policy shifts threaten to reduce these plans’ long-term value, turning supposed safeties into targets. Without alternative strategies, retirees may face withdrawals taxed at ordinary income rates and reduced after-inflation purchasing power.

4. The Inflation Theft Loop

The endless printing of dollars, intended as a stimulus, becomes an unrelenting tide devaluing savings. As purchasing power diminishes, the cost of living surges, disproportionately impacting middle-class families who rely on fixed incomes or savings. Monetary policy designed to stabilize markets often ends up collateralizing the everyday American’s wealth, turning inflation into a silent, grinding tax on prosperity.

5. The Illusion of Fairness

Washington regularly promises reform aimed at “fairness,” but the reality is complexity—ever more tangled, layered, and difficult to penetrate. Rather than leveling the field, new regulations and tax codes create barriers that keep ordinary investors locked out of advanced strategies. This complexity is not accidental; it’s a weaponized system favoring those who can afford elite advice and strategic counsel, leaving the rest to navigate an increasingly opaque sea.

From my seat observing this dynamic for decades, a pattern emerges clearly: A rising tide that lifts the well-connected few while pulling everyone else deeper into the debt undercurrent.

Fighting Back: Three Strategies for Financial Resilience

There is a path to counter this undertow—strategic, legal, and quiet—that can protect your finances and reclaim control from the swamp.

Solution #1: Use the Patriot Tax Loophole

Ad by American Alternative Assets

The truth is brutal: Washington has been bleeding you dry for decades.

Every paycheck—gone. Every tax season—robbed. Meanwhile, the elites use hidden rules to protect their fortunes while hardworking Americans foot the bill.

Trump exposed the scam. And now, the Patriot Tax Loophole is your chance to turn the tables.

This legal, IRS-approved strategy could:

Slash the taxes you hand over to the swamp

Shield your retirement from government grabs

Keep thousands more in YOUR pocket, not theirs

Washington insiders hate this because it puts power back where it belongs—with the people.

That’s why this guide may not be around forever. Once too many Americans start using it, you can bet they’ll slam the door shut.

Click here now to grab your FREE 2025 Wealth Protection Guide before they pull it offline <<

Trump proved you don’t have to accept being ripped off. Now it’s your turn to fight back—and keep what’s rightfully yours.

Solution #2: Diversify Beyond Paper Promises

True resilience demands more than financial instruments prone to inflation and policy shifts. Tangible assets like gold and real estate maintain intrinsic value even as paper currencies weaken. Owning these hard assets provides a bulwark against currency risk and monetary manipulation.

This diversification also symbolizes autonomy—holding wealth in forms that no printing press or tax office can easily redefine or confiscate. Like the ocean’s bedrock beneath shifting tides, tangible assets provide a foundation that endures.

Solution #3: Build Tax-Resilient Income Streams

Reliance on wage income and standard retirement withdrawals leaves many vulnerable to inflation and tax increases. Instead, cultivating income sources through investments, alternative retirement vehicles, and compounding financial strategies generates earnings that can outpace both inflation and taxation over time.

This approach requires foresight and discipline, but delivers financial independence. It is akin to harnessing deep ocean currents and converting their power rather than drifting passively.

🌊 Whale’s Fact Break

Blue whales can lose thousands of pounds during migration—yet they never starve. They draw on reserves patiently built over years, demonstrating that real wealth is maintained through depth, not speed. Survival belongs to those who prepare patiently beneath the surface until the moment to rise is right.

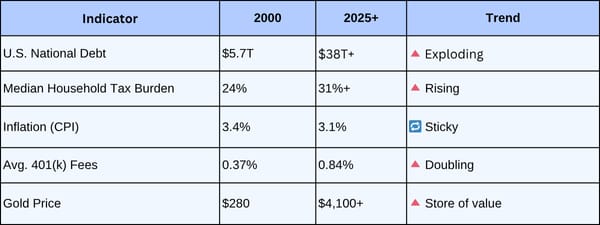

Data Snapshot 📊

|

Survey

Your opinion matters. Click here to take part in our short Whale’s Investing survey — it only takes a minute but helps chart the course for better insights ahead.🌊

Top Picks

🏦 Over 100 U.S. banks have quietly signed on to the new rules. Your IRA, Bank Account, and Savings Can Now Be Frozen Without Warning. - ad by Priority Gold

📺 The Video Musk Showed Trump — Now You Can See It - ad by Behind The Markets

💳 0% APR Cards Just Dropped. Pay Off Debt—Without Paying Interest - ad by Finance Buzz

🧠 BREAKING: Musk’s DOGE Stimulus Goes to the Smartest Americans - ad by American Hartford Gold

Crypto’s Most Influential Event

This May, Consensus will welcome 20,000 to Miami for America’s largest conference for crypto, Web3, & AI.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus is your best bet to market-moving intel, get deals done, & party with purpose.

Ready to invest in your future?

Secure your spot today.

🐳 Whale’s Final Word

Every era reveals the same fundamental tide: power concentration favors the well-informed and agile. Those who learn to navigate the complexities of our financial oceans before reforms or crises impose themselves find enduring security.

Real wealth protection starts below the surface—with strategic action informed by knowledge, not noise. Move deliberately, shield yourself with time-tested diversifications, and leverage legal strategies like the Patriot Tax Loophole before others crowd the lifeboats.

Swim vigilant,

- Whale Investor 🐳