Gold is soaring. But here's what almost no one's talking about...

A way to get a 64% dividend from it.

Not someday. Not in theory.

It's paying real cash, every 30 days.

That means you could be collecting steady monthly payouts from this powerful income machine.

No trading. No complicated options strategy. No risky mining stocks.

Just one click in your brokerage account and the income could start rolling in.

Click here to discover the gold income breakthrough.

The next payout is right around the corner.

Don't miss your chance to start collecting.

Ad by Investors Alley

🐳 Whale’s Note: Why Smart Money Loves Mondays

Good day, dear reader - Whale Investor here.

For many traders and investors, Mondays are synonymous with volatility, uncertainty, and market resets. Yet, beneath this surface churn lies a subtle, recurring rhythm that savvy professionals have quietly exploited for years—a phenomenon known broadly as “Money Monday.” This one-day trading window frequently delivers outsized returns far exceeding those seen on other days. While most market participants overlook it, institutional desks leverage Money Mondays for asymmetric opportunities shaped by weekend sentiment shifts, news digestion, and tactical positioning. In plain sight yet often ignored, this pattern offers a calm operator’s edge, blending strategy with probabilistic advantage.

The Rhythm Beneath the Noise

The early hours of Monday trading often reveal pronounced liquidity gaps and directional movements driven by sentiment forged over the weekend. Investors digest news releases halted since Friday’s close, react to geopolitical developments, and recalibrate risk appetite. This confluence creates predictable market rhythms: price swings more significant relative to risk and volume profiles than the average weekday.

Historical examples highlight the potential. Specific tickers such as MSS have posted intraday gains exceeding 100% during Money Mondays, turning quiet openings into explosive upside runs. This is less about chance and more a structure of market mechanics and psychology. Fridays tend to close with established sentiment, but Monday mornings effectively recalibrate market consensus, amplifying directional moves.

In essence, Money Monday embodies the intersection of behavioral finance and structural liquidity—where the week’s first trading hours concentrate volatility and opportunity. Timing and preparation separate noise traders from professionals; those who harness this window do so with calm, calculated moves rather than chasing random spikes.

IN PARTNERSHIP WITH

If you hate Mondays…

That’s probably because you don’t know about MONEY MONDAYS.

Most traders don’t know this but…

There’s a unique kind of trade you can make every Monday morning…

That often delivers more gains in 1 day than most people see in a year.

Like on one recent Monday…

When you could have ridden MSS for a +149% in one day.

Even with a small $1,000 starting stake… that’s almost $1,500 profit potential!

Of course, I can’t promise you future returns or against losses…

But it’s almost that time again.

Will you join us?

Get our next MONEY MONDAY trade idea here.

The Whale’s Framework for Monday Advantage

Professional traders approach Money Monday scenarios with deliberate frameworks. Capital is allocated specifically toward short-duration trades designed to capture single-day asymmetry, with carefully defined risk ceilings and stop-loss discipline to manage volatility. This strategic allocation enables nimble responsiveness without overexposure to market gyrations.

Build a weekly rhythm portfolio centered on Monday action: use early-week volatility to establish or adjust positions, then employ the remainder of the week for measured positioning or protective hedges. This cadence respects the unique market dynamic wherein early-week momentum often sets the tone for the following days.

Crucially, Money Monday trades are not gambles but data-backed pattern recognition. The confluence of market factors compresses opportunity into concentrated bursts, favoring those who move decisively at the right moment. When volatility concentrates, opportunity compresses — and the traders who move early often define the week’s flow.

🌊 Whale’s Fact Break

The blue whale’s heart weighs nearly 400 pounds — yet beats just once every 10 seconds. Power derived from patience, precision, and perfect timing — the very rhythm the best traders follow each week.

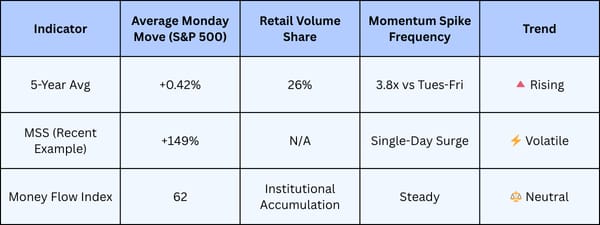

Data Snapshot 📊

|

Top Picks

🏦 Over 100 U.S. banks have quietly signed on to the new rules. Your IRA, Bank Account, and Savings Can Now Be Frozen Without Warning. - ad by Priority Gold

📺 The Video Musk Showed Trump — Now You Can See It - ad by Behind The Markets

💳 0% APR Cards Just Dropped. Pay Off Debt—Without Paying Interest - ad by Finance Buzz

🧠 BREAKING: Musk’s DOGE Stimulus Goes to the Smartest Americans - ad by American Hartford Gold

Prepare your pet for the unexpected

Accidents and illnesses happen when you least expect them. Pet insurance makes sure you’re prepared, with coverage for emergencies, chronic conditions, and wellness visits. Enroll today and give your pet the care they deserve.

🐳 Whale’s Final Word

The best trading opportunities rarely announce themselves. They pulse beneath the market’s surface, visible only to those attuned to underlying rhythms and cycles. Treat Mondays not as noise but as a structured window for disciplined, data-driven actions. Mastering this subtle current transforms volatility from risk into asymmetry.

Swim timely,

- Whale Investor 🐳