🐳 Whale’s Memo: Gold, Debt, and the 1970s Echo - Are We Ready?

Good day, dear reader - Whale Investor here.

Ray Dalio’s recent warning that today’s economy bears a strong resemblance to the tumultuous 1970s marks a pivotal moment for informed investors seeking to navigate the stormy waters of modern finance. This subtle, yet urgent, signal stands apart from the daily noise of market chatter—a whisper beneath the surface that demands careful attention. The early 1970s were defined by soaring inflation, eroding faith in monetary policy, and a surge in gold prices triggered by geopolitical and economic shocks. Today, similar fault lines are reemerging: swelling national debt, precarious fiscal management, and global shifts destabilizing the dominant dollar-based system. History beckons us to learn; the quiet counsel from seasoned insiders such as Dalio and Buffett grows ever more valuable.

The Echo of the 1970s

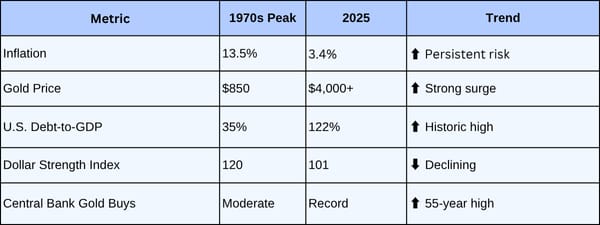

The 1970s unfolded as a decade of economic strain—stagflation came to define this era, a noxious mix of stagnant growth and explosive inflation. Oil shocks in 1973 and again in 1979 ignited costs and rattled trust globally. The U.S. dollar, once underpinned by the gold standard, lost its anchor in 1971 during the Nixon shock, unleashing waves of currency devaluation and uncertainty. Inflation rates peaked above 13.5%, and gold prices surged from $35 to nearly $850 an ounce by the decade’s end.

This period delivered a hard lesson: unchecked fiscal spending, large deficits, and political interference undermined monetary institutions and broke public trust. The interplay of heavy debt and expansive government outlays created a toxic feedback loop, fueling inflation that central banks struggled—and often failed—to contain. The market’s memory of that decade is raw; it is a cautionary tale etched deeply into the psyche of macro-strategists like Dalio.

Today’s economic indicators pulse with familiar warning signs. The U.S. national debt has ballooned to nearly $38 trillion, dwarfing its 35% debt-to-GDP ratio of the ‘70s by more than triple, while the Federal Reserve’s balance sheet swells with emergency asset purchases. Political pressure on the Fed’s independence echoes past missteps, hinting at a compromised ability to restrain inflationary forces. The parallels are stark and gaining strength.

In this murmur beneath public discourse, the voices of the experienced gain resonance. Ray Dalio’s call to heed the 1970s is more than nostalgic reflection; it is a strategic alert. Warren Buffett’s recent comments on dollar weaknesses and insider movements toward alternative assets further underscore an unfolding reality that defies mainstream optimism. For these giants of finance, the lesson of history is a lantern in the fog.

The Modern Fault Lines

Beneath calm economic surface lie cracks that threaten structural failure. The staggering $38 trillion national debt is not merely a number; it is a weight dragging down the dollar’s purchasing power and limiting fiscal flexibility. The Federal Reserve’s balance sheet—embodying years of quantitative easing and crisis interventions—creates dependency that could unravel if confidence erodes. Beyond domestic challenges, seismic geopolitical shifts ripple through the global monetary landscape.

The emergence of the BRICS coalition’s push for de-dollarization is a seismic geopolitical force reshaping world finance. Through initiatives that enable trade in national currencies and alternative clearing systems, these nations signal a collective desire to escape dollar dominance. China’s withdrawal from substantial U.S. Treasury holdings and a surge in global central bank gold buying—reaching 55-year highs—signal anxiety in the fortress of fiat money.

Data shows that central banks across continents have accumulated over 1,000 tonnes of gold annually for multiple years, with key players like China, India, Turkey, and Poland scaling their reserves aggressively. This gold rush among sovereign entities is a silent yet powerful rebuke to paper assets and fiat currencies, mirroring attitudes seen during the 1970s.

The system’s current state is far from mere cyclical turbulence; it is structural fluidity under pressure. The interplay of political interference, high leverage, shifting alliances, and currency competition creates a complex fault line beneath markets. This is a different kind of risk—one that calls for quiet vigilance and prepared action rather than reactive panic.

The Flight to the Tangible

In times where the financial seas grow unpredictable, the most experienced whales—the large, informed investors—turn silently to the tangible. Physical gold, a scarce and universally recognized store of value, rises not merely as an alternative but as a necessity for preservation. Dalio advocates dedicating 15% of one’s portfolio to gold, highlighting its unparalleled role as a non-credit-dependent asset that doesn’t rely on anyone else’s promise to pay.

The surge in gold’s price to above $4,000 per ounce in 2025 reflects this reallocation of trust away from paper instruments to physical, durable wealth. The psychology behind this quiet move is as ancient as investing itself—when the ocean’s surface roils with uncertainty, grave whales dive deep, relying on instinct and tested wisdom rather than surface noise.

For the strategic investor, this is not a speculative impulse but a prudent hedge: a ballast that keeps the ship steady when the winds of inflation and currency debasement blow strong. The flight to gold is informed by the history of cycles, recognizing that trusts built on debt and fiat can falter, but scarcity and physicality endure.

Partner’s Solution

Ad by Cedar Gold Group

Something unusual just happened on Wall Street — and almost nobody’s paying attention.

Ray Dalio — one of the most respected investors alive — made a quiet but chilling statement this week.

No bold headlines. No wild predictions. Just a calm warning:

“What’s happening right now feels a lot like the early 1970s...”

At first glance, it might not sound alarming.

But those who know history — and understand markets — are already acting on his advice.

They’re not waiting for inflation data or Fed meetings.

They’re quietly shifting a portion of their wealth into something real… tangible… and proven to hold value when currencies fail: physical gold.

In fact, Dalio goes on to reconfirm his stance on the yellow precious metal stating everyday Americans:

“...should allocate as much as 15% of their portfolios to gold…”

Because if you remember what followed the 1970s — runaway inflation, collapsing currency values, and skyrocketing commodity prices — you understand why Dalio’s words sent a shiver through seasoned investors.

He’s seen this movie before.

And this time, he says the ending could be worse.

Unlike the 1970s…

The U.S. national debt is now approaching $38 trillion.

Our currency is weakening both at home and abroad.

And Washington’s only “solution” seems to be printing more money.

Behind closed doors, the biggest players are already preparing.

Billionaires are quietly moving their wealth out of paper assets — and into hard assets that can’t be devalued overnight.

If you have a 401(k), IRA, or TSP, you have the same opportunity they do — a simple, IRS-approved process that allows you to move part of your retirement savings into physical gold without paying an extra cent in unnecessary taxes or penalties.

That’s why we created the Wealth Protection Guide — a free resource that reveals:

The real meaning behind Ray Dalio’s warning (and what it signals for the U.S. economy)

Why today mirrors the early 1970s more than most people realize

How to protect your savings with physical gold — 100% tax- and penalty-free

Click here to claim your FREE Wealth Protection Guide now.

You don’t need to be a billionaire to act on the same insights the world’s smartest investors already are.

But you do need to move before the cycle completes — because once confidence in the dollar cracks, it happens fast.

P.S. When Ray Dalio speaks, the markets listen — eventually. But by the time the headlines catch up, it’s often too late to act.

Reserve your Wealth Protection Guide TODAY — before the rest of America wakes up.

🌊 Whale’s Fact Break

Blue whales dive more than 1,000 feet searching for nourishment—conserving precious energy by trusting long-honed instincts rather than reacting to fleeting surface noise. So too do wise investors move quietly beneath market turbulence, relying on deep understanding and history instead of transient headlines.

Data Snapshot 📊

|

Survey

Your opinion matters. Click here to take part in our short Whale’s Investing survey — it only takes a minute but helps chart the course for better insights ahead.🌊

Top Picks

⏳ 2025: Retirement Age Will Rise—Are You Ready? - ad by American Alternative Assets

🏦 Top Five U.S. Banks Preparing for Massive Change to Checking & Savings Accounts? - ad by Brownstone Research

🆓 Grab your Free Bitcoin! Just attend one of this week’s exclusive workshops, immerse yourself in the knowledge, and complete a short quiz completely free – no catch, no purchase necessary - ad by Goodrise

🛠️ The hidden scandal behind CBDC - ad by American Alternative Assets

🐳 Whale’s Final Word

Markets ebb and flow in cycles as true as the tides themselves. The wisdom lies not in prediction but in preparation—listening to the undercurrents while others chase surface noise. Ray Dalio’s measured warning is a compass pointing toward prudence, an invitation to steady your course with tangible assets grounded in history and scarcity.

Swim protected,

- Whale Investor 🐳