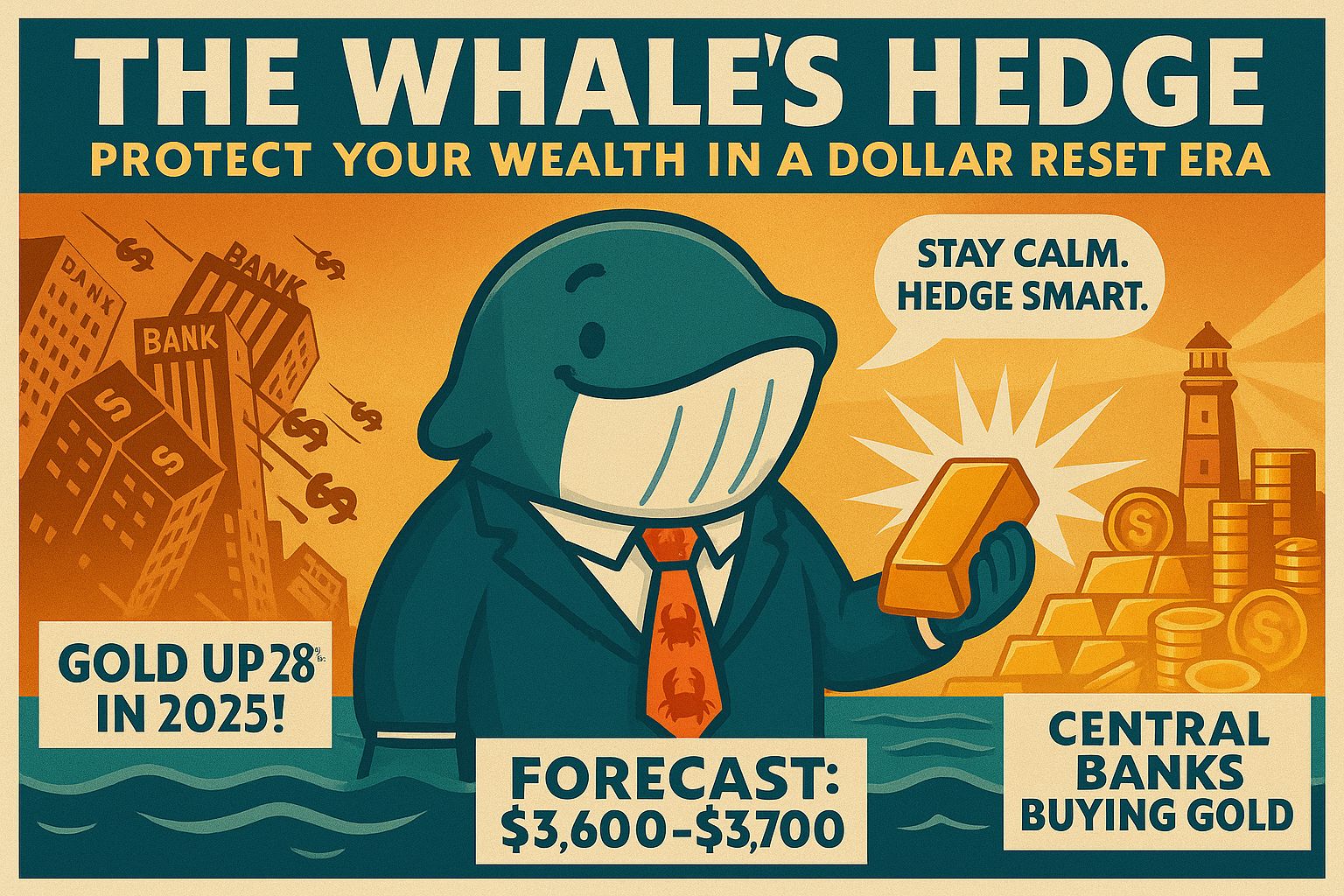

🐳 The Whale’s Hedge: Protecting Wealth in a Dollar Reset Era

Inflation isn’t just a minor annoyance—it’s a silent tide steadily eroding your savings without warning. Now, with growing chatter about a potential return to the gold standard, the entire financial game could be about to flip.

For the savvy whale investor, this isn’t a moment for panic. It’s a moment for smart positioning.

Gold’s Big Year So Far

In 2025, gold isn’t just rallying—it’s dominating. It’s outperforming stocks, bonds, currencies, and even Bitcoin, up roughly 28% year-to-date.

Institutional demand is fueling this surge through ETFs, and bullish forecasts have gold potentially hitting $3,600 to $3,700 an ounce by mid-2026. The heavy hitters are moving fast—and that momentum’s only building.

The Whale's Insight:

If you ever thought about investing in gold and silver, but never was sure how to start, I've got a good news for you. My contact at Reagan Gold Group just put together an essential, no-fluff guide which reveals 7 secrets you need to know to start investing in physical gold and silver.

I read it already and can assure you: it’s straight to the point - no fluff, no empty promises - just clear, actionable insights. And I arranged exclusive free access for my readers. These spots won’t last long, so if you would like to, apply while it's available for free.👇

Sponsored by Reagan Gold Group

👉 Get Reagan's Free Guide, while it's still free for my readers.

Market Pulse: Gold Today

Current Price: Spot gold is steady just shy of $3,395 per ounce, with many eyes watching closely for a breakout above $3,400.

Investor Outlook: Central banks and ETF inflows continue to surge. The global trend of de-dollarization is accelerating, with reserve managers increasingly turning to gold as their safe harbor.

Bullish Forecasts: RBC and other top institutions are calling for gold to average around $3,700 an ounce next year, supported by robust institutional demand.

🌊 A Whale Fact Break

Here’s a remarkable fact: blue whales can hold their breath and stay submerged for up to 90 minutes. No stress. No rushing. Just calm, unwavering endurance.

That’s the mindset we want in choppy markets—steady, patient, and ready to ride the waves.🐳

Gold, Silver And Opportunities They Open

Gold and silver aren’t just shiny relics from the past—they’re the anchors that keep real wealth steady when the seas get rough. Gold gives you strength, silver gives you speed. Together, they’re like the whale’s tail—powerful enough to cut through storms and steady enough to carry you forward. In 2025, they open doors not just to protection, but to growth: hedging against inflation, diversifying your portfolio, and giving you a path that politicians and central bankers can’t easily sink. Think of it as your ticket—not to survival, but to a wealthier, freer future.

🐳 Whale’s Final Word

In a dollar-reset world, gold isn’t just another asset—it’s your ballast. While headlines chase checks and tweets, the true wealth preservation happens where politicians aren’t pulling the strings.

Diversify smartly: a little gold, some growth plays, and plenty of room to swim. Keep calm, hedge smart, and let the tide do the lifting.

Whales Investing 🐳