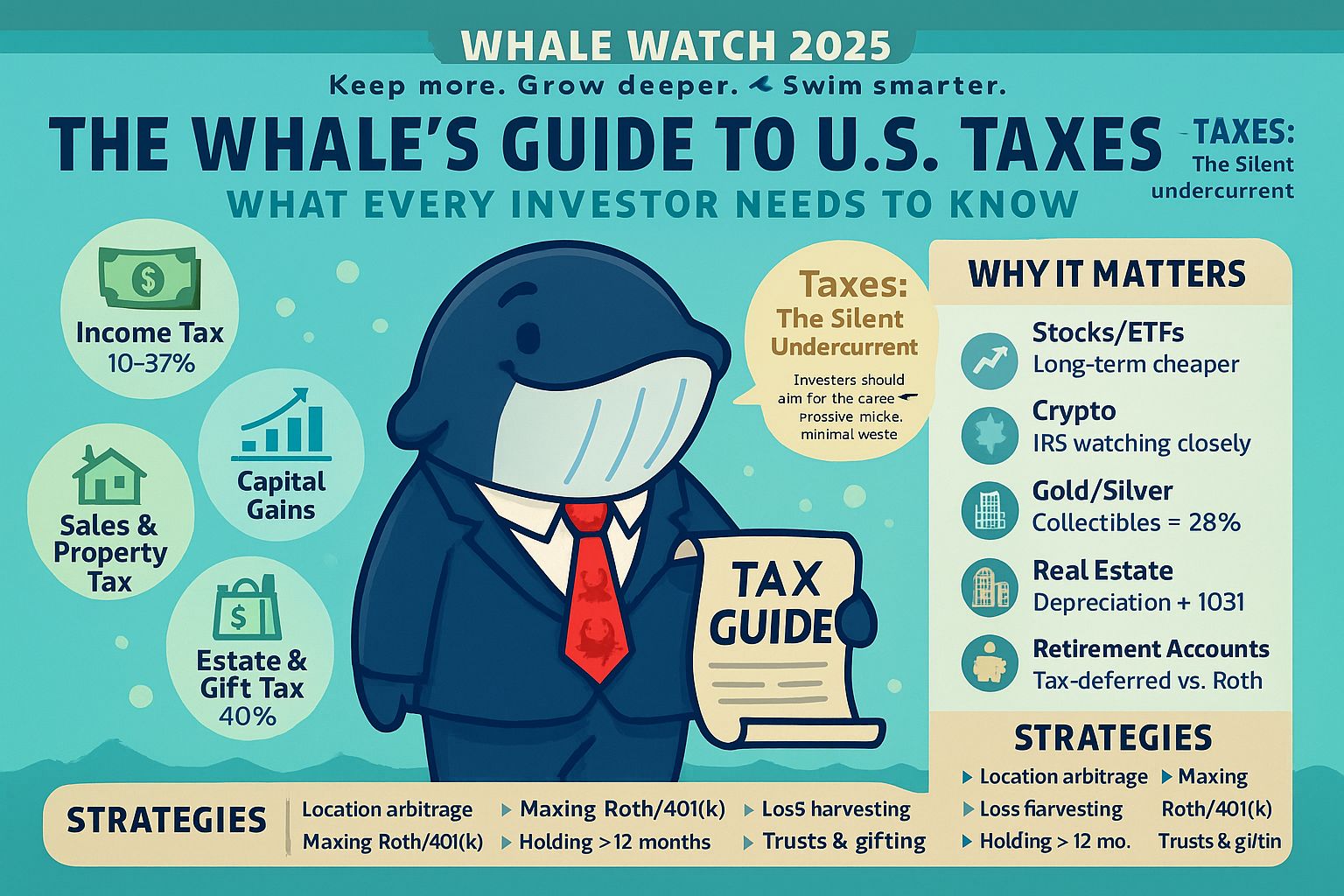

🐳 The Whale’s Guide to U.S. Taxes

Most investors focus on what they earn - not what they keep. In America, taxes are the silent undertow that can drag even the strongest portfolio off course. To swim like a whale, you need to know what kinds of taxes exist, who pays them, and how they impact your wealth.

Core Types of U.S. Taxes

Income Tax (Federal & State): Paid by individuals on wages, salaries, and investment income. Federal brackets run from 10% to 37%; some states (like Texas and Florida) have no income tax, while California tops out near 13%.

Capital Gains Tax: Profit from selling assets (stocks, real estate, crypto). Short-term (held <1 year) taxed like ordinary income; long-term (held >1 year) capped at 20% federally (plus 3.8% NIIT for high earners).

Payroll Taxes: Cover Social Security (12.4% split between employer/employee) and Medicare (2.9% total, plus a 0.9% surtax for high earners).

Corporate Tax: Currently 21% at the federal level, with additional state levies.

Estate & Gift Tax: Transfers above ~$13M per person (2025 threshold) taxed at up to 40%.

Sales & Property Taxes: Local burdens that vary wildly. Sales tax can reach 10%+; property taxes depend on location and home value.

Why Taxes Matter for Investors

Stocks & ETFs: Long-term holding = lower rates, short-term = high hit.

Crypto: Same as capital gains; plus IRS is watching wallets closely.

Gold & Silver: Classified as collectibles → taxed up to 28% on gains.

Real Estate: Can benefit from depreciation write-offs and 1031 exchanges.

Retirement Accounts: IRAs/401(k)s defer taxes; Roth accounts grow tax-free (if rules followed).

The Whale’s Tax Warning

Americans already spend thousands each year just to keep up with taxes. But here’s the kicker: banks quietly take even more through high-interest debt. My friends at Finance Buzz just showed me a unique offer that can help almost anyone stop overpaying.

Ad by Finance Buzz

Paying 20%+ interest isn’t “debt management.” It’s a rigged game.

Banks profit while you sink.

But there’s a way out:

A 0% APR card for up to 21 months on balance transfers.

That’s nearly two years of interest-free breathing room.

Click here to see if you qualify and stop paying for their mistakes.

Strategies Whales Use

Location Arbitrage: Living or spending time in no-income-tax states.

Tax-Advantaged Accounts: Maxing Roth IRAs, HSAs, 401(k)s.

Harvesting Losses: Selling losers to offset winners.

Timing: Holding assets for >12 months to qualify for long-term rates.

Legacy Planning: Trusts and gifting strategies to manage estate tax exposure.

🌊 Whale’s Fact Break

Blue whales eat up to 4 tons of krill per day, but they do it with efficiency — filtering thousands of gallons of water through baleen in minutes. Investors should aim for the same: massive intake, minimal waste.

🐳 Whale’s Final Word

Taxes aren’t just an April headache — they’re a permanent part of your investing ocean. Ignore them, and you’ll bleed returns. Master them, and you’ll compound like a whale. The goal isn’t to evade the current — it’s to ride it smarter, keep more of your earnings, and build wealth that lasts beyond one market cycle.

Whales Investing 🐳