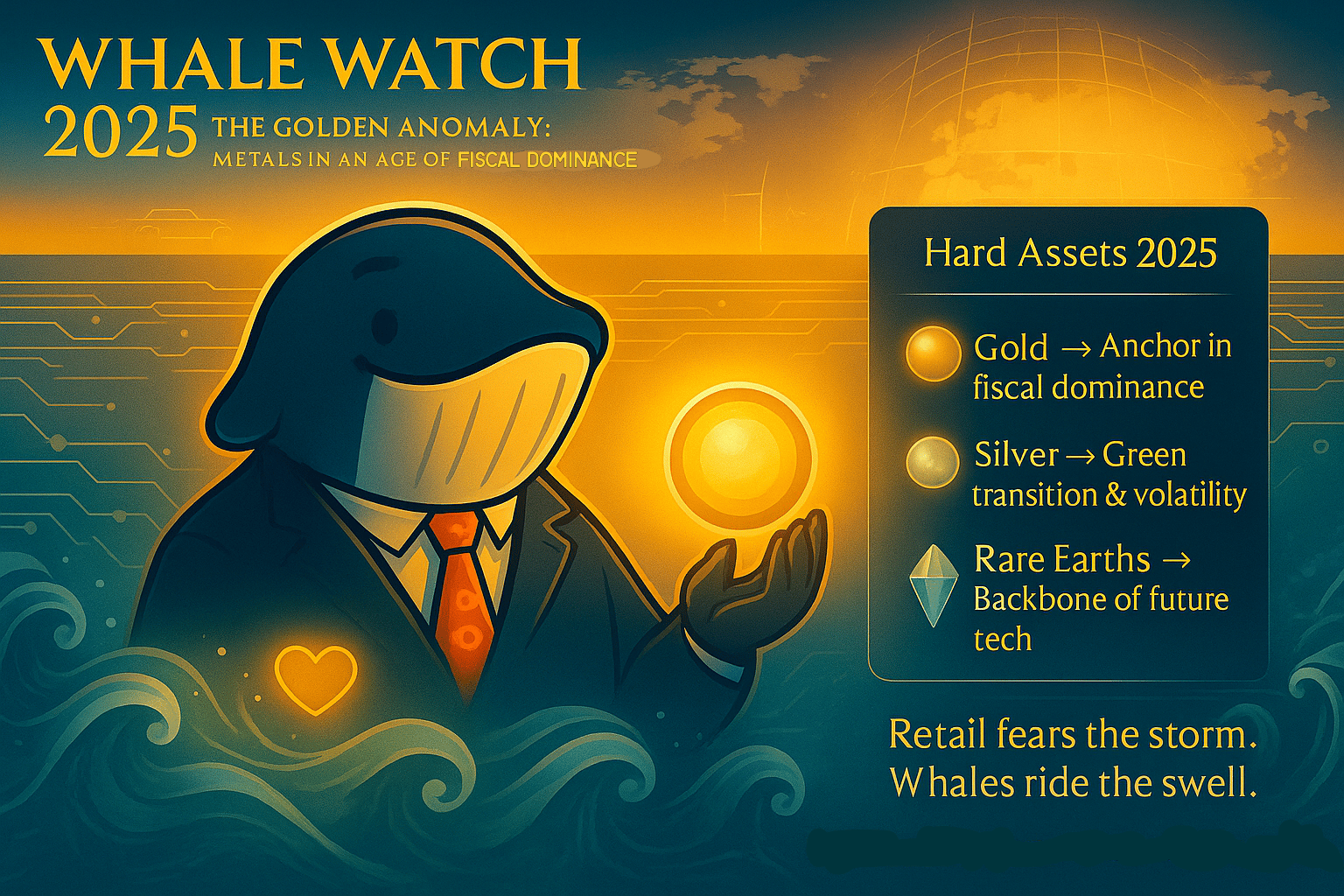

🐳 The Whale’s Deep Dive: Rare Earths, Gold, and Silver in 2025

When most investors think of metals, they stop at gold and silver. But beneath the waves lies an entire ecosystem of rare earth elements - the unseen backbone of everything from EV batteries to advanced military tech.

In 2025, the race for these resources is no longer just about mining - it’s about geopolitics, supply chains, and financial survival. Let’s break it down.

Rare Earths: The Invisible Powerhouse

Neodymium, dysprosium, terbium - hardly household names, yet they make the modern world possible. They’re essential for EV motors, wind turbines, smartphones, and fighter jets.

China currently controls over 60% of global production, tightening its grip through export restrictions. Meanwhile, the U.S. and EU are scrambling to fund new mines and secure independent supply chains. In whale terms: this isn’t just an investment play - it’s a national security moat.

Gold: The Anchor in Uncertain Currents

While rare earths fuel the future, gold remains the ballast. In 2025, with inflation still gnawing and central banks expanding reserves, gold has held strong near record highs.

It’s more than metal - it’s monetary insurance. Central banks have bought over 1,000 tons in the past year, signaling what the deepest-pocketed players already know: when the dollar trembles, gold doesn’t.

Silver: The Underestimated Workhorse

Silver rarely gets the spotlight, but its dual role as a precious and industrial metal makes it uniquely positioned. It’s critical for solar panels, EVs, and electronics, while still maintaining its store-of-value appeal.

Analysts project demand for silver in solar could rise 40% by 2030, pushing supply chains to the brink. Unlike gold, silver is more volatile - but that volatility can be a whale’s friend when currents shift.

Your Guide to Hard Assets

Here’s where things get interesting. A close partner of mine flagged something Wall Street whispers are now calling “fiscal dominance.”

It means government spending drives the ship - and the Fed just follows. Inflation or not.

If that sounds dangerous for bonds, you’re right. But for gold, it’s a setup we haven’t seen in decades. And one of my trusted friends has put together a full breakdown of this moment - the Golden Anomaly

Sponsored by Golden Portfolio

With the “Buffett Indicator” at 213% – telling you stock values are the highest they’ve ever been...

And Trump bending the Fed to his agenda…

Gold is setting up for a supercycle.

👉 I call this setup The Golden Anomaly – and it could deliver transformative returns for those who act now.

🌊 Whale’s Fact Break

Did you know? A blue whale’s heart weighs around 400 pounds - roughly the size of a piano. Even giants need a strong anchor. For investors, gold has been playing that role for millennia.

🐳 Whale’s Final Word

Rare earths drive technology. Silver powers the green transition. But gold? Gold guards your wealth when the tide of paper money turns.

A whale doesn’t fear rough seas - it uses them to its advantage. And right now, the smartest move is to study the currents of fiscal dominance and prepare for the golden supercycle ahead.

Stay anchored. Stay alert. Swim deeper.

Whales Investing 🐳