📈 The "Heat" Crisis: Why We Are rotating Capital Out of Software and Into Physics

Hello friends, Mr. Whale here.

I want to have a serious conversation about Physics.

I know, you subscribed to this letter to read about stocks, yields, and asymmetric upside. You want to know where the Smart Money is flowing. But right now, you cannot understand the flow of money if you do not understand the flow of Heat.

For the last three years, the narrative has been simple: "Buy the Brain." The "Brain" is the GPU. It is Nvidia. It is the silicon chip that does the thinking. We poured trillions of dollars into making the Brain faster, smarter, and denser. And we succeeded. We built a Ferrari engine that can drive humanity to Mars.

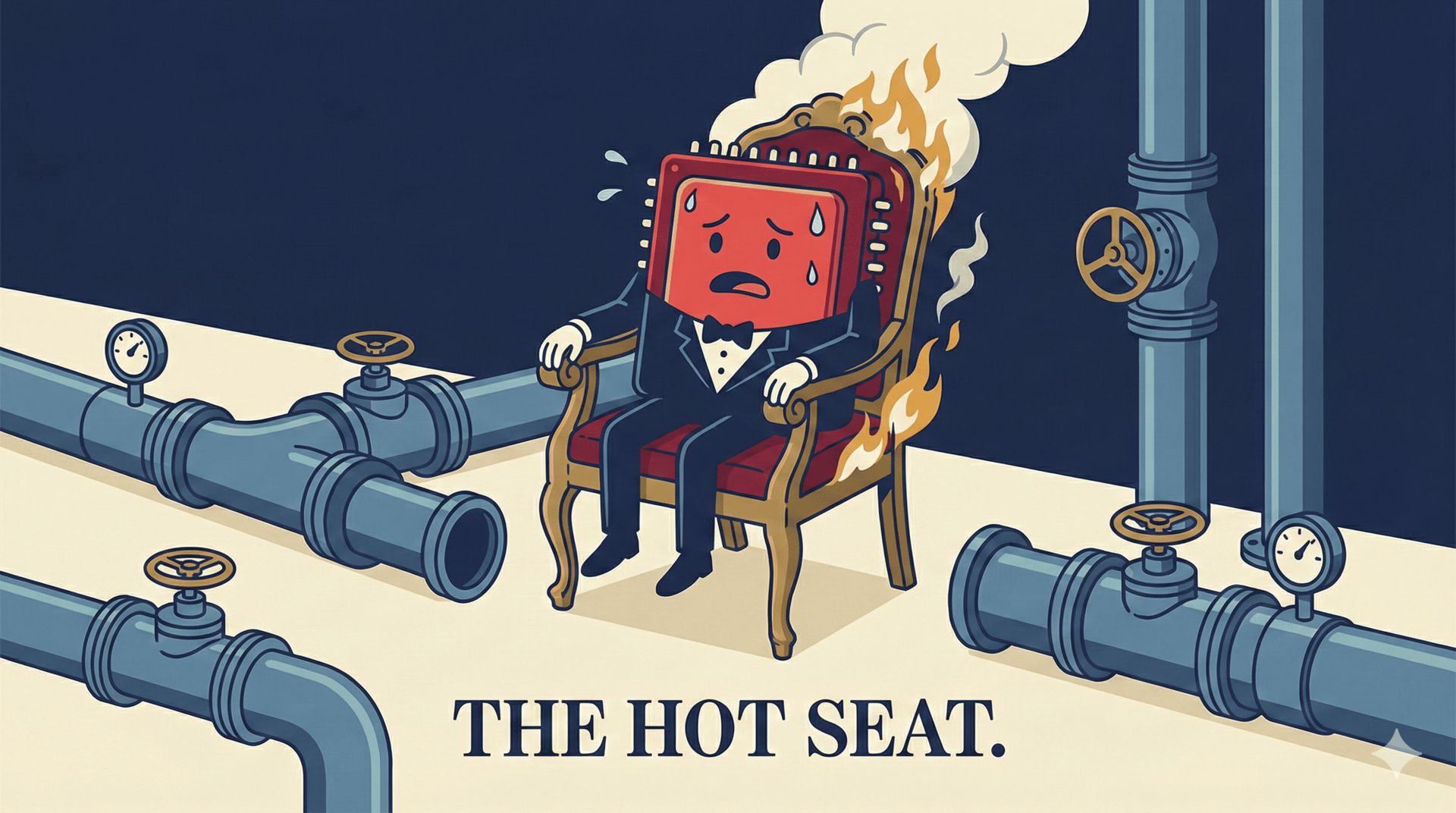

But there is a problem that the pitch decks in Silicon Valley are glossing over. We put that Ferrari engine inside a wooden wagon.

The "Meltdown" Thesis

The current infrastructure of the internet - the data centers, the cooling systems, the power grids - was built for the Google Era. It was built for retrieval (searching for a cat video). It was not built for the AI Era (generating a Pixar movie in real-time).

The new Blackwell chips from Nvidia are not just computer parts; they are industrial heaters. When you stack 100,000 of them together to build a "Super-Intelligence," you create a thermal event so massive that standard air conditioning fails. The cables melt. The power delivery units fry. The "Brain" overheats and shuts down.

The Capital Rotation

This brings us to the most important rule of Whale Investing: Capital flows to the Bottleneck.

When gold was discovered in California, the bottleneck wasn't the gold; it was the transport and the tools. In 2026, the bottleneck is no longer the "Compute" (we have plenty of chips). The bottleneck is the "Support System."

We are seeing a massive, silent rotation in institutional portfolios. We are trimming our exposure to the "Glamour Stocks" (the software companies) and we are loading up on the "Boring Stocks."

The companies that make the liquid cooling pipes.

The companies that manufacture the optical interconnects.

The companies that manage the voltage regulation.

The "Plumbing" is the Play

To the retail investor, these companies sound boring. They don't have charismatic CEOs in leather jackets. They make valves, pumps, and cables. But to the Whale, these companies look like Monopolies.

If Nvidia wants to sell a $30,000 chip, they must pair it with a $5,000 cooling solution. They have no choice. This creates a "forced adoption" cycle. The "Power Partners" that supply these components are not optional. They are critical. And unlike Nvidia, which is trading at a massive valuation multiple, many of these infrastructure plays are still trading like boring industrial stocks.

The Valuation Gap

This is the arbitrage. The market is pricing these companies as if they are selling plumbing for toilets. In reality, they are selling plumbing for the most advanced technology in human history. When the market wakes up to this reality - when they realize that Physics is the new Software - the re-rating will be violent.

This is why I pay attention when insiders like Jeff Brown start talking about "Power Partners." He isn't talking about the headline news; he is talking about the plumbing. And that is where the real margin is made

Continued for those who want the specific mechanism of profit.

🐳 The "Super-System" Theory: Why The Sum is Greater Than the Parts

Let’s talk about Structure. In the venture capital world, we have a saying: "Amateurs buy products. Professionals buy ecosystems."

What is about to happen in the AI market is a shift from selling a "Product" (The GPU) to selling an "Ecosystem" (The AI Factory). Nvidia CEO Jensen Huang knows this. He is arguably the greatest strategist of our generation. He knows that his chips are hitting the physical limits of Moore's Law. To get more power, he can't just make the transistors smaller anymore. He has to connect more chips together.

The "Jan 6" Significance

The promo mentions a specific date: Jan 6, 2026. In the financial calendar, early January is often when the major tech roadmaps are unveiled (CES, strategic updates). We believe this date signifies the official unveiling of the "Super-System."

This is where Nvidia says: "We are no longer selling you a chip. We are selling you a rack. And inside that rack are components from Company A, Company B, and Company C."

The "Supplier Multiplier" Effect

This is where the wealth is created. Nvidia is a $3 Trillion company. For its stock to double, it needs to add another $3 Trillion in value. That requires moving mountains.

But the "Power Partners" - Company A, B, and C? These are likely Mid-Cap companies, valued at $10 Billion or $20 Billion. If they become the standard for the Nvidia Super-System, their revenue doesn't just go up 10%. It goes up 10x. They experience the "Supplier Multiplier."

The "Cisco" Lesson of 2000

I want to take you back to the year 2000. Everyone loved Cisco. It was the "Nvidia" of the internet boom. But the people who made the absolute most money weren't just the Cisco shareholders. It was the shareholders of the companies that made the optical fibers (JDS Uniphase, Corning) that allowed Cisco routers to talk to each other.

The "pipes" became more valuable than the "routers" for a brief, explosive window of time. We are entering that window for AI. The "Brain" (Nvidia) is established. Now the "Nervous System" (The Partners) must catch up.

How to Position

Most investors are lazy. They will just buy an AI ETF and hope for the best. But an ETF is diluted. It holds the winners and the losers. The "Whale" approach is surgical. We want to own the specific companies that solve the heat problem, the power problem, and the connection problem.

Jeff Brown has done the legwork here. He has identified the 7 specific partners that are effectively "married" to Nvidia's new architecture. If you own these stocks before the Jan 6 announcement, you are front-running the institutional algos. If you wait until after the announcement, you are paying the retail premium.

The Bottom Line

The easy money in AI has been made. The hard money - the sophisticated money - is now being made in the infrastructure layer. This is not a gamble. This is a calculation based on the laws of physics. The heat must go somewhere. The data must flow somewhere. Bet on the pipes.

If you've read this far, you're my kind of investor. You look past the shiny object and check the engine. Here is the link again to get the names of the partners:

|

Sponsored Content

Top Picks from Partners We Trust

|

If you had to lock 50% of your net worth into ONE asset class for 10 years, what would it be?

Your feedback is important to us. Here are the results of yesterday's poll:

12/15 Poll - How do you pick your stocks?

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|