📈 The $900B Shift: The Death of the "Legacy Drink"

If you look at the portfolios of the "Old Guard" - the institutional giants who have held consumer staples for forty years - you will see a lot of "Sin Stocks." Tobacco. Sugary Soda. Cheap Beer.

For decades, the thesis was simple: In good times or bad, people will drink, smoke, and consume sugar. It was the ultimate defensive moat.

But at Whales Investing, we track structural shifts, not just cyclical ones. And right now, the data is screaming that the "Sin Stock" moat is drying up.

The "HealthSpan" Consumer

We are witnessing the rise of the "HealthSpan" consumer. This is a demographic (mostly 30-55, high disposable income) that is obsessed with longevity. They aren't stopping consumption; they are upgrading it.

They don't want a $12 bottle of wine that gives them a headache and inflammation. They want a $25 organic, low-sulfite varietal.

They don't want a sugary soda. They want a functional seltzer with adaptogens that improve focus.

They don't want cheap light beer. They want a zero-proof botanical spirit that tastes complex but keeps them sharp for a 6 AM meeting.

The Volume Problem

Look at the volume numbers for legacy beer and soda giants. They are flatlining or declining in developed markets. The only way they are keeping revenue up is by raising prices (inflation). That is not a growth strategy; that is a survival strategy.

Meanwhile, the "Better-For-You" beverage sector is seeing double and triple-digit growth.

This creates a massive arbitrage opportunity. The legacy giants are too slow to innovate. They are like oil tankers trying to turn in a canal. This leaves a vacuum for agile, mid-sized challengers to capture market share.

The "Premiumization" Trap

Legacy brands are stuck. If they lower quality to save money, they lose customers. If they raise prices, they lose volume.

The emerging "Wellness Platforms" don't have this problem. They are native to the premium price point. Their customers expect to pay more because they aren't buying a drink; they are buying a lifestyle outcome (better sleep, more focus, no hangover).

We will discuss exactly how to invest in this shift. Hint: You don't try to pick the single winning drink flavor. You invest in the infrastructure that owns the shelf.

🐳 The M&A Super-Cycle: Why the Giants Are Paying 6x Multiples

We talked about the consumer shift away from cheap booze and toward "functional" wellness drinks. That’s the trend. Now, let’s talk about the money.

At Whales Investing, we love a "Cornered Animal" trade.

Right now, the global alcohol giants (the "Big Bev" conglomerates) are cornered. Their flagship beer volumes are dropping. Gen Z and Millennials aren't drinking their sugary, mass-produced spirits.

The giants have two choices:

Try to invent a cool, authentic wellness brand (which they are terrible at).

Buy the winners.

The "Acquisition" Premium

We are entering a historic M&A (Mergers & Acquisitions) cycle in the beverage space. The giants are sitting on billions in cash, but they have zero growth. So, they are going shopping.

And they are paying premiums that are shocking to the average investor.

When a standard company gets bought, it might sell for 1x or 2x revenue.

But a high-growth "Wellness Brand" with a cult following? We are seeing deals happen at 4x, 5x, even 6x revenue multiples.

Why? Because the giants aren't just buying the drink; they are buying the growth. They are buying the future.

The AMASS Position

This is why we are watching AMASS Brands so closely. They haven't just built a nice little wine company. With $80M in revenue and a portfolio of 15+ brands, they have built a "Target."

They are sitting in the "Goldilocks Zone":

Too Big to Ignore: $80M revenue is serious market share.

Too Fast to Catch: 1,000% growth means they are stealing customers faster than the giants can react.

Ready for Liquidity: By reserving the Nasdaq ticker ($AMSS), they have created a "dual-track" pressure.

This gives them leverage. They can either go public (IPO) and let the market price them, OR they can force a massive buyout from a conglomerate terrified of missing out.

The "Whale" Strategy

As an early investor, you don't care which exit they choose. You win either way.

Scenario A (IPO): The stock hits the public markets, the "Liquidity Premium" kicks in, and you have a liquid asset.

Scenario B (Buyout): A giant writes a check for $500M+ to acquire the platform, and early shareholders get cashed out.

The only way to lose this trade is to wait until after the news breaks. By then, the premium is gone. The smart money positions itself while the company is still private, securing the bonus shares and waiting for the "Panic Buy" to begin.

Whale Pulse Check: How do you prefer your "Exit Strategy"?

- The IPO Pop: I want them to ring the bell on Nasdaq ($AMSS) so I can hold the stock long-term

- The Cash Buyout: I prefer a quick, clean exit where a giant (like Diageo or Constellation) buys the company for cash

- The Dividend Machine: I don't want an exit; I want them to stay private and pay me dividends from the profits

- I'm Undecided: I just want exposure to the growth, I'll let management decide the exit

Your feedback is important to us. Here are the results of yesterday's poll:

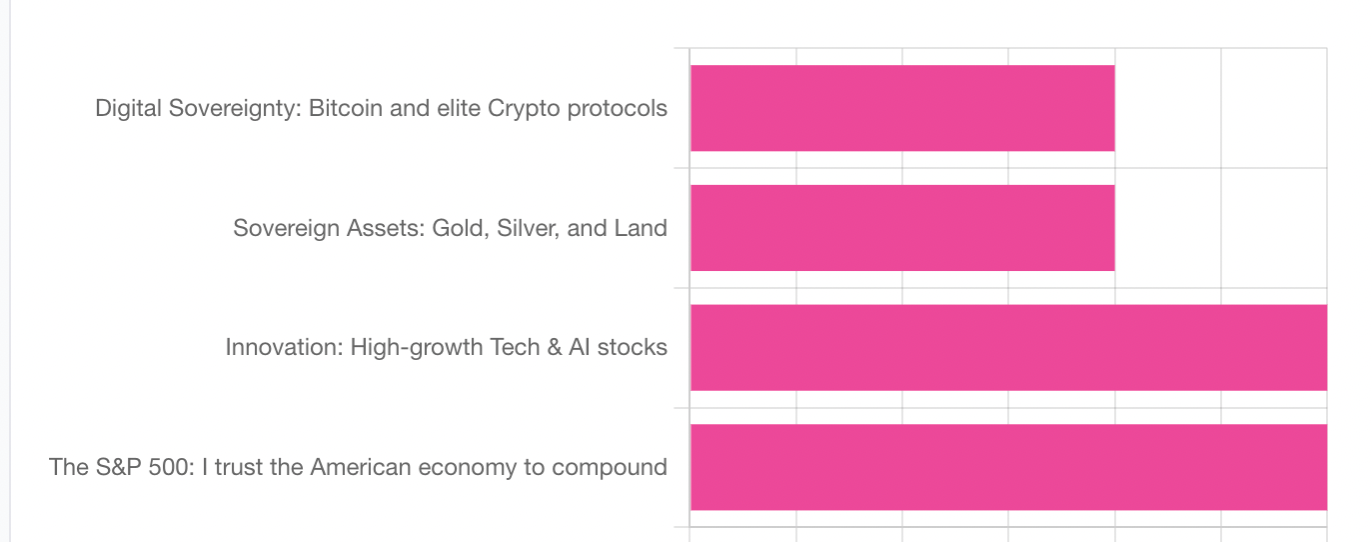

12/16 Poll - If you had to lock 50% of your net worth into ONE asset class for 10 years, what would it be?

|

Sponsored Content

Top Picks from Partners We Trust

|

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|