📈 The Fusion Gamble

Gentlemen, stop looking at the ticker symbol for a moment. Stop looking at the political headlines. Stop looking at the noise.

Yesterday, Trump Media & Technology Group (DJT) announced a definitive merger agreement with TAE Technologies, a private nuclear fusion pioneer, in a deal valued at nearly $6 billion.

If you are a retail investor, you are probably looking at this through a political lens. You are asking what this means for Truth Social, or for the former President’s polling numbers, or for the volatility of the stock price next week.

If you are a "Whale" - an institutional capital allocator - you are seeing something entirely different. You are seeing a white flag of surrender from the "Digital-Only" economy and a desperate, massive pivot toward Hard Infrastructure.

For twenty years, Silicon Valley has sold us a lie. They told us that the economy was moving entirely into the cloud. They told us that "bits" were more valuable than "atoms." They told us that we could print infinite prosperity through software, social media, and ad-revenue models, without worrying about the physical constraints of the real world.

That era ended yesterday.

When a media company - whose primary asset is a social network - decides to pivot its entire treasury into Nuclear Fusion, it is an admission that the "Attention Economy" has peaked. It is an admission that the next Trillion dollars of value will not be generated by likes, shares, or retweets. It will be generated by Megawatts.

We are witnessing the "Great Rotation." Capital is fleeing the ephemeral world of media and rushing into the tangible world of energy physics. And if you are not positioned for this rotation, your portfolio is stuck in 2024.

The Energy Cliff

To understand why this deal happened, you have to understand the crisis staring Big Tech in the face. We call it the "Energy Cliff."

For the last three years, the world has been obsessed with Artificial Intelligence. Nvidia has sold billions of dollars worth of GPUs. Microsoft and Google have built data centers the size of small cities. We have built the "Brain" of the future.

But we forgot to buy the food to feed it.

A standard Google search uses about 0.3 watt-hours of electricity. A ChatGPT query uses nearly 3 watt-hours. That is a 10x increase. The next generation of AI models - the "Reasoning Engines" currently being trained - are projected to use 100x the power.

The United States electrical grid is tapped out. In Northern Virginia (Data Center Alley), utility companies have already told developers that they cannot hook up new servers until 2028. The grid is old. It relies on aging natural gas peaker plants and intermittent renewables like wind and solar that simply cannot provide the "baseload" power required to run AI clusters 24/7.

The "Whales" know this. Sam Altman knows this. Elon Musk knows this. And clearly, the team at DJT knows this.

They realized that owning the "Platform" (Truth Social) is worthless if the lights go out. But owning the Power Source? That makes you the most powerful landlord in the digital age.

Why Fusion? Why Now?

Fusion has always been the "joke" of the energy sector. "It's twenty years away, and always will be."

But TAE Technologies is not a joke. Backed by Google, Chevron, and Sumitomo, they have been quietly solving the plasma physics problem for two decades. Unlike traditional nuclear fission (which splits atoms and creates radioactive waste), fusion mimics the sun. It slams atoms together to release massive amounts of energy with zero carbon and zero meltdown risk.

This merger suggests that the technology has crossed the threshold from "Science Project" to "Commercial Viability."

If TAE has cracked the code on "A-neutronic Fusion" (using Hydrogen-Boron fuel), they have effectively solved the energy equation for humanity.

Infinite Fuel: Hydrogen and Boron are abundant.

Zero Carbon: No emissions.

Base Load: It runs 24/7, unlike solar or wind.

By merging with a public company (DJT), TAE gains access to the massive liquidity of the public markets without the scrutiny and delay of a traditional IPO roadshow. It is a backdoor listing for what could be the most important technology of the 21st century.

The Pivot from Media to Infrastructure

This deal represents a broader trend we are tracking at Whales Investing: The Industrialization of Tech.

Look at Amazon. They aren't just a website anymore; they are a logistics and robotics company. Look at Tesla. They aren't just a car company; they are a battery and utility company. Look at DJT. They are no longer a media company; they are an energy infrastructure holding company.

The market is rewarding companies that own Hard Assets. Inflation is sticky. Currencies are being debased. In that environment, owning the "means of production" (Energy) is infinitely safer than owning the "means of distribution" (Media).

The skeptics will look at this deal and scream "Distraction!" But the pragmatist looks at the balance sheet. DJT is effectively turning itself into a Special Purpose Acquisition Company (SPAC) for energy. They are using their high stock valuation as currency to buy real-world assets.

It is a brilliant financial maneuver. It converts "Meme Stock" equity - which is volatile and fundamentally disconnected from earnings - into "Infrastructure" equity, which has intrinsic value.

The Geopolitical Angle

We must also consider the geopolitical chessboard. Energy independence is no longer just about gas prices; it is about AI Supremacy.

China is building nuclear reactors at a pace the West cannot match. They understand that the country with the cheapest, most abundant electricity will win the AI race. If China can train an AI model for $10 Million in electricity, and it costs the US $100 Million to train the same model because of energy scarcity, we lose.

This merger has likely been blessed, unofficially, by the national security apparatus. The US Government needs private capital to flow into Fusion fast. They cannot wait for Department of Energy grants. They need Wall Street greed to fuel the physics.

By creating a "Meme Stock" for Fusion, the market is effectively crowd-funding the Manhattan Project of the 21st century.

The "Dual-Use" Technology

Let’s go deeper. TAE’s technology relies on "Field Reversed Configuration" (FRC) plasma devices. While the primary use is energy generation, the underlying physics - accelerating beams of particles and controlling high-energy plasma - has military applications.

Directed Energy Weapons: High-energy lasers require massive, pulsed power sources.

Space Propulsion: Plasma thrusters are the future of orbital maneuvering.

The investor who buys this narrative isn't just buying a utility bill. They are buying a defense contractor. The convergence of Big Tech and the Defense Industrial Base is accelerating. We are seeing a return to the "Arsenal of Democracy," but this time, the arsenal is powered by Silicon Valley software and Fusion physics.

The Risk Profile

Now, let’s be the "Skeptical 40+ Man" for a minute. Is this a guaranteed win? Absolutely not. Fusion is notoriously difficult. "Net Energy Gain" (getting more power out than you put in) has been elusive for decades.

If TAE fails to deliver a commercial reactor by 2030, this $6 Billion bet goes to zero. This is not a "Widow and Orphan" stock. This is a venture capital bet wrapped in a public ticker.

However, the asymmetric upside is undeniable. If it works, it is not a 2x or 3x return. It is a 100x return. It changes the GDP of the entire planet.

How the Whale Invests

So, what is the actionable advice here? At Whales Investing, we do not chase headlines. We do not buy DJT at the top of a news spike.

We look for the "Second Derivative" trades. If Fusion is real, and if Energy is the bottleneck, who else wins?

Copper Miners: You cannot build a fusion reactor or the new grid to support it without millions of tons of copper.

Superconductor Manufacturers: Controlling plasma requires advanced superconducting magnets.

The "Brains": And this is the most critical one. If we solve the energy problem, we unlock the full potential of AI.

The only reason AI hasn't taken over the physical economy yet is because it is too expensive and power-hungry to run "at the edge" (in robots, drones, and factories). Cheap, abundant fusion energy unlocks the "Embodied AI" revolution.

The Bridge

This brings us to the crux of our thesis. Energy is just the fuel. It is the gasoline. But gasoline is useless without an engine.

The "Engine" of the next decade is Actionable Intelligence. It is the software that takes this unlimited energy and turns it into economic output. It is the AI that pilots the drone, manages the supply chain, and predicts the market.

While the world is distracted by the shiny object of Fusion, a quiet revolution is happening in the "Decision Layer" of AI.

We are going to pivot from the "Macro" (Energy) to the "Micro" (The Opportunity). We are going to discuss a specific company that is building the intelligence layer that this energy will power. A company that is already operational, already generating revenue, and currently available at a price point that makes the fusion gamble look expensive by comparison.

The Fusion deal was the starting gun. The race is now on to own the Intelligence.

🐳 The Swarm Economy

The Engine and the Fuel

We established a fundamental truth about the current market cycle: The search for Power is desperate. The $6 Billion merger between DJT and TAE Technologies proves that the elites are betting the house on Fusion Energy.

But let’s ask the "Second Derivative" question: What are they going to DO with all that power?

They aren't building fusion reactors just to keep your refrigerator running. They are building them to power the Intelligence Economy.

If Fusion is the "Fuel," then Autonomous Decision Making is the "Engine." And right now, while the headlines are obsessed with the fuel, the engine is being built in the private markets, largely unnoticed by the retail herd.

The "Drone Swarm" Wake-Up Call

Last week, military observers were stunned by leaked footage of a drone swarm operation. It wasn't the explosion that was scary; it was the coordination. Hundreds of drones moved like a flock of starlings. They shared targets. They adapted to jamming. They made split-second decisions without a human pilot touching a joystick.

This is the future of software. It is no longer about a human typing a prompt into a chatbot. It is about Agentic AI - software that has a goal, perceives the environment, and acts to achieve that goal.

This technology doesn't stay in the military. It never does.

GPS started as a missile guidance system. Now it runs Uber.

The Internet started as a nuclear-proof comms network (ARPANET). Now it runs Amazon.

Swarm Intelligence started as a weapon. Now it is coming for the Fortune 500.

The Crisis of ROI

Let’s look at the corporate world. It is a mess. Companies like Hasbro, MGM, and L’Oreal are drowning in data. They have terabytes of customer info, sales figures, and market trends. But they are starving for ROI (Return on Investment).

They spent billions on "Generative AI" (ChatGPT) last year, and what did they get? They got funny emails and AI-generated images. They didn't get profit. The C-Suite is angry. They are demanding tools that actually move the needle on the bottom line.

They don't need a poet. They need a sniper. They need an AI that says: "Stop spending money on Facebook ads in Ohio. Move that budget to TikTok influencers in Florida. Do it now."

This is the transition from "Generative AI" to "Predictive AI." And this is where the smart money is flowing.

The "RAD" Solution

This brings us to the specific opportunity we are highlighting today: RAD Intel.

While the world chases the "Fusion" hype, RAD Intel has been quietly building the "Brain" for the corporate world. They have developed a proprietary AI technology called "Atomic Reach."

Think of it as a "Drone Swarm" for marketing and capital allocation. It ingests massive amounts of data - content performance, audience demographics, historical sales - and it makes autonomous recommendations on where to deploy capital for maximum return.

This is not a concept. It is a product. And more importantly, it has Validation.

The Clients: We aren't talking about mom-and-pop shops. We are talking about Hasbro, MGM, Skechers, and L'Oreal. These are giants. They don't buy "vaporware." They buy results.

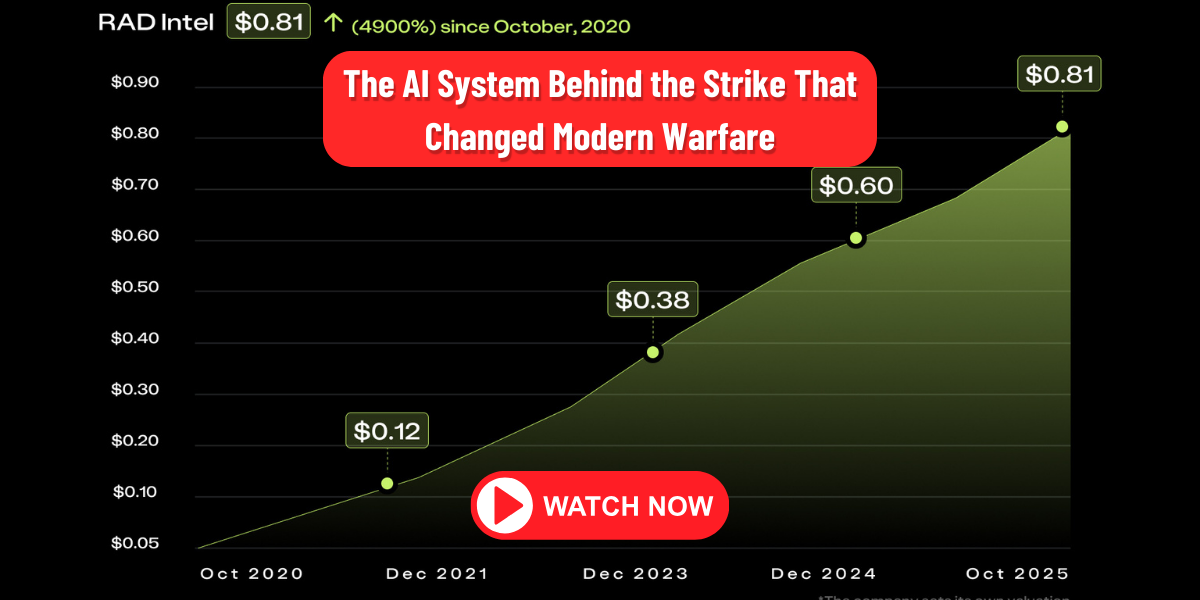

The Numbers: According to their SEC filings, RAD Intel has seen massive valuation growth - up nearly 5,000% since their seed round.

The Ticker: They have already reserved the symbol $RADI on the Nasdaq.

The "Reg A+"

Now, let’s talk about the specific investment mechanic, because this is where the "Whale" strategy comes into play.

Usually, a company like this is locked away. It’s "VC only." Unless you can write a $5 million check and know a partner at Sequoia Capital, you can't get in. You have to wait for the IPO, by which time the stock is already trading at $30 a share and the easy money is gone.

RAD Intel is using a Regulation A+ offering. This is a loophole - created by the JOBS Act - that allows regular investors to buy into private companies before they go public.

Right now, the share price is $0.85. Let that sink in. You are buying into a company with Fortune 1000 clients, a reserved Nasdaq ticker, and a proprietary AI stack... for less than a dollar a share.

When/if they ring the bell on the Nasdaq, the market will price them like a tech stock. The gap between $0.85 and that opening price is the "Whale" profit zone.

The "Decision Layer" Moat

Why is this safer than betting on a fusion reactor? Because the Decision Layer is sticky.

Once a company like Hasbro integrates RAD Intel into their marketing stack, they can't just turn it off. It becomes their brain. It becomes the system that tells them how to spend their money. If they turn it off, they go blind.

This creates a Moat. In investing, we love moats. We love recurring revenue. We love technology that becomes "mission critical."

Fusion is a "Moonshot." It might work, it might not. RAD Intel is a "Pick and Shovel." Companies must market themselves. They must spend budgets. RAD just makes sure they don't waste it.

The Roadmap to Liquidity

The ultimate goal for any private investment is the "Exit." We look for signals that management is preparing for this event.

Audited Financials: Check. (Required for Reg A+).

Institutional Backing: Check. (Adobe and Fidelity Ventures have backed the ecosystem).

Public Ticker Reservation: Check. ($RADI).

These are not the actions of a lifestyle business. These are the actions of a company preparing for the "Big Show."

The timing is critical. The "window" for these Reg A+ offerings is not infinite. Once the round closes, or once the S-1 filing for an IPO is submitted, the door slams shut for the retail investor at this price point.

Conclusion - The "Dual-Pillar" Portfolio

So, how do you construct the perfect portfolio for 2026? You need to balance the Macro with the Micro.

The Macro Play: Energy. The DJT/TAE merger is the signal. You want exposure to Fusion, Copper, and Uranium. This is your "Long Term Defense."

The Micro Play: Intelligence. RAD Intel ($RADI). This is your "High Growth Offense." This is the asset that captures the efficiency gains powered by that energy.

The world is changing fast. The footage of the drone swarm was a warning: Adapt or Die. The merger of DJT and TAE was a signal: Power is King.

The offer from RAD Intel is the solution: Own the Brain.

You can stay on the sidelines and watch the "Smart Money" consolidate their grip on the future. Or you can take a page out of their playbook. Buy the infrastructure. Buy the intelligence. And do it while the price is still measured in cents, not dollars.

What topics are you interested in the most?

|

Sponsored Content

Top Picks from Partners We Trust

|

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|