📈 The "Mar-a-Lago" Signal: Why the Mainstream Media is Blind to the Real Economy

Hello friends, Mr. Whale here.

On the trading floor, there is the "Public Tape" (what you see on CNBC) and there is the "Private Tape" (what is whispered at dinner parties in Greenwich, Palm Beach, and Davos).

If you trade off the Public Tape, you are "Retail." You are reacting to news that has already been digested by the algorithms. If you trade off the Private Tape, you are a "Whale." You are positioning yourself for the news before it happens.

This brings us to a specific event that just happened at Mar-a-Lago.

While the mainstream media is obsessed with political theater and "gotcha" moments, they completely miss the economic signals being sent by the people actually running the country.

The "Patriot's Advantage"

We’ve recently received intel regarding a message delivered by a man who served on one of Trump's top advisory boards. This isn't a pundit. This is a personal friend of the President. A man who has been in the room where it happens.

He revealed something that has made a lot of people in the establishment uncomfortable.

Why? Because the establishment thrives on the status quo. They thrive on you believing that the economy is a random walk, that inflation is "transitory," and that you should just put your money in a 401(k) and shut up.

But the "Patriot's Advantage" is understanding that policy drives profit. When an administration signals a shift - whether it's regarding energy independence, deregulation, or currency wars - capital moves fast.

The "Asymmetry" of Information

In the ocean, the shark detects a drop of blood from a mile away. The little fish doesn't know there is danger until he is being eaten.

Right now, there is "blood in the water" regarding the old economic order. The signals coming out of Mar-a-Lago suggest a massive pivot is coming. A pivot that favors:

Domestic Production (Reshoring).

Hard Assets (Real wealth vs. paper wealth).

Financial Sovereignty (Breaking the grip of globalist banking).

The media won't touch this story because it contradicts their narrative. They want you focused on the noise. Mr. Whale wants you focused on the Signal.

By the way, usually, you have to be a donor with a $100,000 plate at a fundraising dinner to hear this kind of unfiltered economic roadmap, but I found a way for you to watch the full message directly

Continued for those who want the masterclass (Now let's get back to Policy Arbitrage)

🐳 The "Policy Arbitrage": Investing Where the River Flows

If you take one lesson from Mr. Whale today, let it be this: Don't fight the Fed, and don't fight the White House.

The government is the biggest "Whale" in the ocean. When they decide to spend $1 Trillion on infrastructure, construction stocks go up. When they decide to subsidize green energy, solar stocks go up. When they decide to drill, oil stocks go up.

This is called Policy Arbitrage.

The "Mar-a-Lago Message" is essentially a cheat sheet for the next 4 years of Policy Arbitrage.

1. The "Reshoring" Trade For 30 years, the trade was "Globalization." Ship jobs to China, buy cheap goods. The new trade is "Nationalism." If the policy is to bring manufacturing back, you don't buy the shipping companies (Maersk). You buy the Industrial Automation companies (Rockwell, Emerson) and the Domestic Logistics companies (Old Dominion, JB Hunt). Why? Because we can't afford American labor prices without robots. The "America First" policy is actually a "Robotics First" policy in disguise.

2. The "De-Dollarization" Hedge The establishment hates talking about this, but the BRICS nations (Brazil, Russia, India, China) are trying to kill the dollar. If the Mar-a-Lago signal suggests that the U.S. will weaponize the dollar or print more of it to fund the debt, you need insurance. The Whale's insurance isn't cash. It's Gold and Strategic Commodities (Copper, Lithium, Uranium). These are assets that cannot be sanctioned or printed into oblivion.

3. The "Deregulation" Boom If the new administration slashes red tape, the biggest beneficiaries are Small Cap Stocks and Financials. Big banks love regulation because it acts as a moat that keeps competitors out. Small banks and businesses hate regulation because it crushes their margins. If we see a wave of deregulation, the Russell 2000 (IWM) becomes the most explosive trade on the board.

The "Uncomfortable" Truth

The promo says this message makes people "uncomfortable." Good. Profit is usually found in uncomfortable places. It is uncomfortable to bet against the consensus. It is uncomfortable to buy oil when the world screams "Green." It is uncomfortable to buy gold when the world screams "Bitcoin."

But comfort is the enemy of profit. The herd is comfortable. The herd gets slaughtered. The Whale is uncomfortable. The Whale eats.

Whale's Break

Politics is noise. Policy is profit. Stop listening to what politicians say on TV to get votes. Start listening to what they say to their donors behind closed doors. That is where the roadmap is.

Whale's Final Word

The "Mar-a-Lago" signal is likely the most important macro-economic indicator of the year. Not because of politics, but because of Capital Allocation. Trillions of dollars are about to move based on this new direction. You can stand in front of the train, or you can get on board.

If you've read this far, you're definitely my kind of person. You understand that the best intel doesn't come from the nightly news. Here is the link again to watch the full message

|

Sponsored Content

Top Picks from Partners We Trust

|

Mr. Whale asks: Do you trust the "Official Narrative" on the economy?

Your feedback is important to us. Here are the results of yesterday's poll:

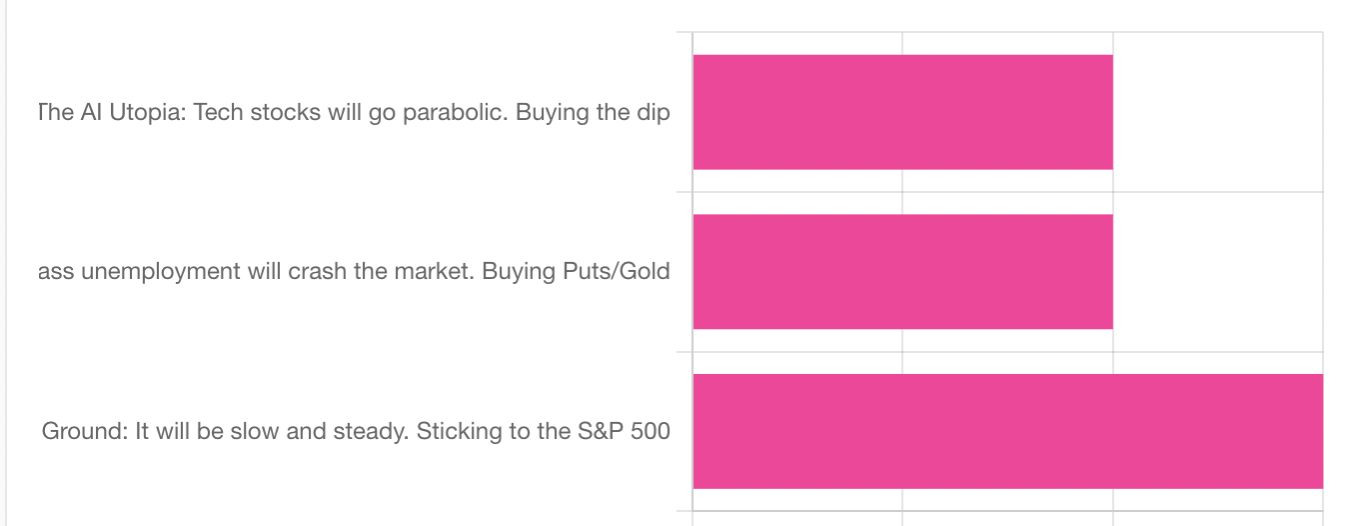

12/11 Poll - The "Final Displacement" creates two worlds. Which one are you betting on?

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|