The "Exit Liquidity" Trap

The Psychology of the Top

Welcome back.

At Whales Investing, we study history because human nature never changes. There is a distinct phase in every major bull market known as the "Distribution Phase." This is when the "Smart Money" (Institutions, Insiders, Whales) begins to quietly offload their positions to the "Dumb Money" (Retail Investors, The Crowd) who have just arrived at the party.

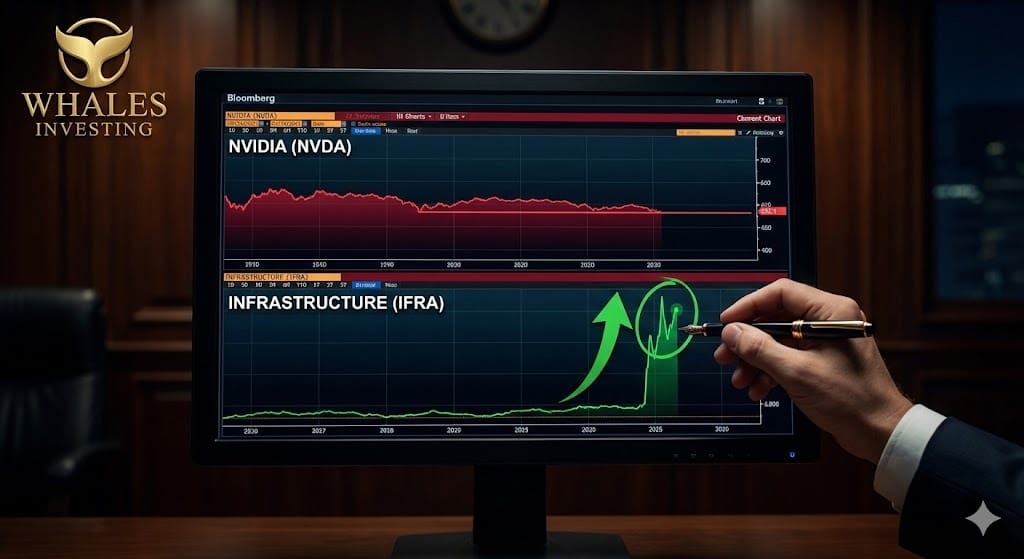

Right now, Nvidia (NVDA) and Palantir (PLTR) are the most crowded trades on the planet. When your Uber driver, your dentist, and your nephew are all giving you stock tips on the same three companies, the "Easy Money" has already been made. The Law of Large Numbers is undefeated. For a $3 Trillion company to double again, it needs to add another $3 Trillion in value—roughly the entire GDP of the United Kingdom. Is it possible? Maybe. Is it probable? The risk-reward ratio is no longer in your favor.

Legendary investor Whitney Tilson has seen this movie before. He remembers the Dot-Com bubble. He remembers when Cisco was the "Nvidia" of 2000. Everyone owned it. Everyone loved it. And then, it went nowhere for 15 years. The Whales are not chasing Nvidia here. They are rotating. They are looking for the next leader of the bull market.

The "Pick and Shovel" Arbitrage

Why "Boring" is Beautiful

The market is currently making a massive pivot from "The Brains" (AI Chips) to "The Body" (Infrastructure). Think about it: You can buy all the H100 chips in the world, but if you don't have the data center space to house them, the electricity to power them, and the liquid cooling systems to keep them from melting, they are useless.

The "Stealth Stock" Whitney Tilson mentions is playing this exact arbitrage. While everyone fights over the chips, this company provides the critical infrastructure that every AI company needs. The grading system he uses flagged this stock with a 94/100. In the world of quantitative analysis, that is a statistical anomaly. It suggests a company that has:

Pricing Power: They can raise prices without losing customers.

Widening Margins: They are becoming more profitable as they scale.

Reasonable Valuation: Unlike the tech giants, this stock hasn't been bid up to the moon yet.

The "Whales" love these trades. We call them "Asymmetric Bets." The downside is limited because the valuation is grounded in reality, but the upside is explosive because the entire AI industry relies on their hardware.

The Institutional AI Portfolio (Beyond Chips):

VRT (Vertiv Holdings): The Thermodynamics Play. As chips get faster, they get hotter. Vertiv controls the market for high-performance liquid cooling. You cannot build a modern data center without them.

ETN (Eaton Corp): The Grid Play. AI consumes ungodly amounts of electricity. Eaton builds the switchgear and transformers to deliver that power. This is a 10-year supercycle.

AMT (American Tower): The Real Estate Play. The physical land and towers where the edge computing revolution happens. A classic "Whale" holding for dividends and growth.

SO (Southern Company): The Utility Play. Regulated utilities are signing massive contracts with hyperscalers (Microsoft/Google) to provide nuclear and baseload power.

Front-Running the "Second Wave"

Position for the "Hard" Reality

Investing is about anticipation. If you buy what is popular today, you are paying a premium for yesterday's news. The "Second Wave" of the AI boom will be physical, not digital. It will be about copper, steel, power, and cooling.

The N.E.W. System that Whitney Tilson developed is essentially a "Quant Filter." It ignores the noise of CNBC and Twitter and looks purely at the fundamentals. When a system like that flashes a "Buy" signal on a forgotten sector, it is usually the start of a multi-year trend. The crowd is still looking at the sky (Software). The smart money is looking at the ground (Hardware/Infrastructure).

|

Sponsored Content

Top Picks from Partners We Trust

|

🐳 Analyst's Note:

"In our private fund flows, we are seeing a significant deceleration of inflows into semiconductor ETFs. At the same time, heavy machinery and electrical equipment sectors are seeing their highest accumulation volumes in a decade. The 'Smart Money' isn't leaving the casino; they are just moving to a different table. You should too."

Bottom Line

The era of "blindly buying Tech" is ending. We are entering a stock-picker's market where valuation matters again. The 94/100 rating on this infrastructure stock is a rare signal. Ignore the FOMO. Check the data. Position yourself in the assets that make the AI revolution physically possible.

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|