📈 Beyond the Chip: Why the "Smart Money" is Looking Up

Introduction: Don't Buy the News

If you opened your brokerage app yesterday, you probably saw green. Dell and Nvidia surged again. The headlines are screaming "AI Boom!" and telling you to buy.

Let me give you a piece of advice that has saved me millions over the years: When the taxi driver gives you a stock tip, it's time to sell.

The "Chip Trade" is crowded. Everyone knows Nvidia is the king. Everyone knows data centers need servers. The valuation multiples on these stocks are priced for absolute perfection. If you buy now, you aren't an investor; you are exit liquidity for the institutions who bought three years ago.

At Whales Investing, we don't chase the bus that just left the station. We look for the next bus.

And right now, the most important infrastructure play in the world isn't happening in a server room in Silicon Valley. It's happening 500 kilometers above your head.

The "AI Bottleneck" No One Talks About

We talk a lot about "Compute Power" (Chips). But we rarely talk about "Transport Power" (Connectivity).

Imagine building the fastest Ferrari engine in the world (Nvidia's AI), but trying to drive it on a dirt road full of potholes (Legacy Telecom).

The current global internet infrastructure is ancient. It relies on undersea fiber-optic cables that are expensive to lay, vulnerable to sabotage (as we've seen recently), and physically slow due to the refractive index of glass.

AI models are becoming decentralized. Your self-driving car, your autonomous tractor, and your remote mining drone need massive data throughput instantly. They can't wait for a signal to bounce through a dozen routers and an undersea cable.

This is the bottleneck. And one man - Elon Musk - has already built the solution while the rest of the market was distracted by chatbots.

The "Orbital" Moat

Jeff Brown, a tech analyst I respect for his "boots on the ground" research, calls this the "New Global Backbone."

We are talking about Low Earth Orbit (LEO) satellite constellations.

Most people think of "Satellite Internet" as that slow, clunky dish you used at a cabin in 2005. That is dead tech. The new network (Starlink) uses Laser Links in a vacuum.

Here is the physics: Light travels 47% faster in the vacuum of space than it does in glass fiber. For a High-Frequency Trader (HFT) in New York trading in Tokyo, that speed difference is worth billions. For a military drone pilot, that speed difference is life or death.

Elon hasn't just built an ISP for rural farmers. He has built the fastest global network in history. And because he owns the rockets (SpaceX), his cost to deploy this network is a fraction of what it would cost AT&T or Verizon to even try to compete.

He has a monopoly on physics.

The Investment Pivot

So, how do we play this?

You can't buy SpaceX stock on Robinhood. It's private. But Jeff Brown has identified a "Backdoor" way to play this trend. He has found a specific equity that is poised to benefit from this massive orbital build-out.

This is the classic "Pick and Shovel" play.

Don't bet on the Gold Miner (too risky).

Bet on the guy selling the Shovels (guaranteed cash flow).

The infrastructure is being built now. Every week, 60 more satellites go up. The network density is reaching a tipping point where it becomes the default carrier for global enterprise.

In next part, we will look at the sheer scale of this market - the "Total Addressable Market" (TAM) - and why this could be the first $10 Trillion industrial sector.

🐳 The $2 Trillion "Dead Zone" Opportunity

Introduction: The Map is Dark

Look at a coverage map of 5G towers. It looks great in New York, London, and Tokyo. Now look at the ocean. Look at Africa. Look at the rural Midwest. It's a dead zone.

For 50 years, the telecom industry has operated on a simple, brutal economic rule: "If the population density is low, we don't build." It costs too much to dig a trench to a farmhouse or a remote factory. So, half the planet is disconnected.

Elon Musk didn't look at the map and see a problem. He saw a $2 Trillion Opportunity.

Space-as-a-Service (SaaS)

We are witnessing the birth of a new utility. Just like electricity in the 1920s or highways in the 1950s, Ubiquitous Connectivity is becoming the prerequisite for the modern economy.

Maritime Logistics: Shipping containers tracking themselves in real-time in the middle of the Pacific.

Agriculture: Autonomous combines harvesting corn in Nebraska, controlled by an AI in Chicago.

Defense: Drones operating in deserts where no cell tower exists.

This is "Space-as-a-Service." And unlike terrestrial telecom, which has high marginal costs (digging more trenches), satellite internet has Zero Marginal Cost once the bird is in the air. Adding the 1-millionth subscriber costs the same as adding the first one. That is the recipe for massive profit margins.

The "Liquidity Event"

Here is why we are writing this today. The "Smart Money" knows that SpaceX/Starlink will eventually have a liquidity event. It might be an IPO. It might be a spin-off.

When that happens, it will likely be the biggest financial event of the decade. The valuation estimates are already hitting $200 Billion and climbing.

But most retail investors are waiting for the IPO. They are waiting to buy the stock on Day 1 at $100/share. That's fine. You'll make money. But the real money - the "Whale" money - is made by positioning yourself before the S-1 filing drops.

Jeff Brown's research is focused on this pre-IPO window. He is looking at the suppliers, the partners, and the specific market mechanisms that allow investors to get exposure to this orbital economy now, while it is still being built.

Conclusion: Hardware Phase 2

The AI revolution has two phases. Phase 1 was Digital: Nvidia chips, OpenAI chatbots, Data Centers. That trade is mature. Phase 2 is Physical: Satellites, Robotics, Energy. That trade is just beginning.

Where is the next "Trillion Dollar" value unlock?

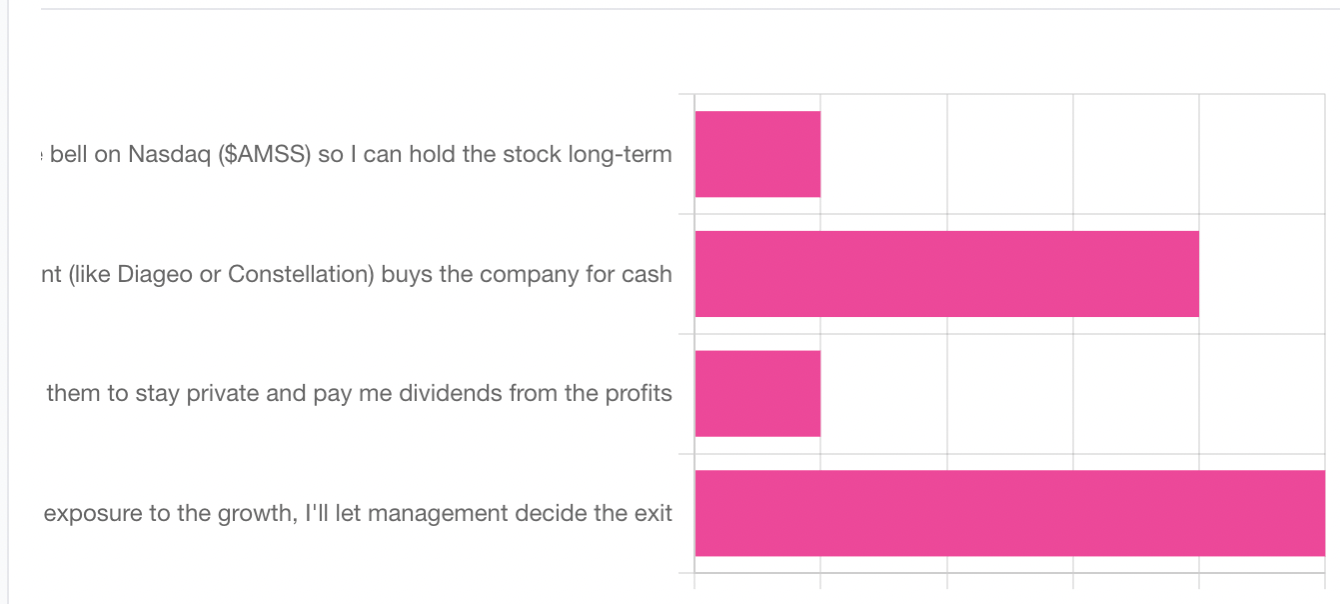

Your feedback is important to us. Here are the results of yesterday's poll:

12/17 Poll - Whale Pulse Check: How do you prefer your "Exit Strategy"?

|

Sponsored Content

Top Picks from Partners We Trust

|

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|