📈 The "Greater Fool" Theory: Why Buying Nvidia Now Is a Rookie Mistake

Hello friends, Mr. Whale here.

There is a moment in every major bull market that I call "The Retail Top." It’s not necessarily the day the market crashes. It’s the day when the "Little Fish" finally feel safe enough to swim into the open water. They see their neighbor making money on Nvidia. They see headlines about Palantir on every news site. They hear Uber drivers giving stock tips about Amazon.

So, they buy. They buy at the top of the chart, convinced that the line only goes up.

This is the "Greater Fool" Theory. You buy an expensive asset not because it’s undervalued, but because you hope a "Greater Fool" will come along and buy it from you for even more. But here is the hard truth: If you are buying Nvidia right now, there might not be any fools left.

The "Smart Money" Rotation

While the retail crowd is chasing the "Magnificent 7" stocks at all-time highs, the Whales are quietly exiting the building. We aren't selling because we hate AI. We are selling because the Risk/Reward ratio has flipped. Why risk capital on a company that needs to grow 50% just to justify its current price, when you can find "stealth" stocks that are trading at a discount?

The Whitney Tilson Warning

I’ve been reading the research from Whitney Tilson recently. If you don't know the name, you should. He’s a legendary investor who has navigated these bubbles before. He just issued a controversial warning: "The AI boom is real... but the next wave of gains won't come from where everyone expects."

He believes AI mania is about to leave millions of investors "holding the bag." If you are heavy in the popular names - Nvidia, Amazon, Palantir - you are standing on a trapdoor.

The "Hidden" AI Winner

However, Tilson isn't bearish on the technology. He is bullish on a specific, little-known stock that the crowd has completely missed. He didn't find it by watching CNBC. He found it using a proprietary Stock Grading System that he spent years developing. This system just flagged this specific stock with a 94 out of 100 rating. In the quantitative world, that is a "Strong Buy" signal that is almost impossible to ignore.

By the way, usually, these quantitative systems cost $20,000 a year to access via a Bloomberg terminal, but Whitney is doing something unprecedented and giving away the system demo and the ticker for free

Continued for those who want to invest like a pro.

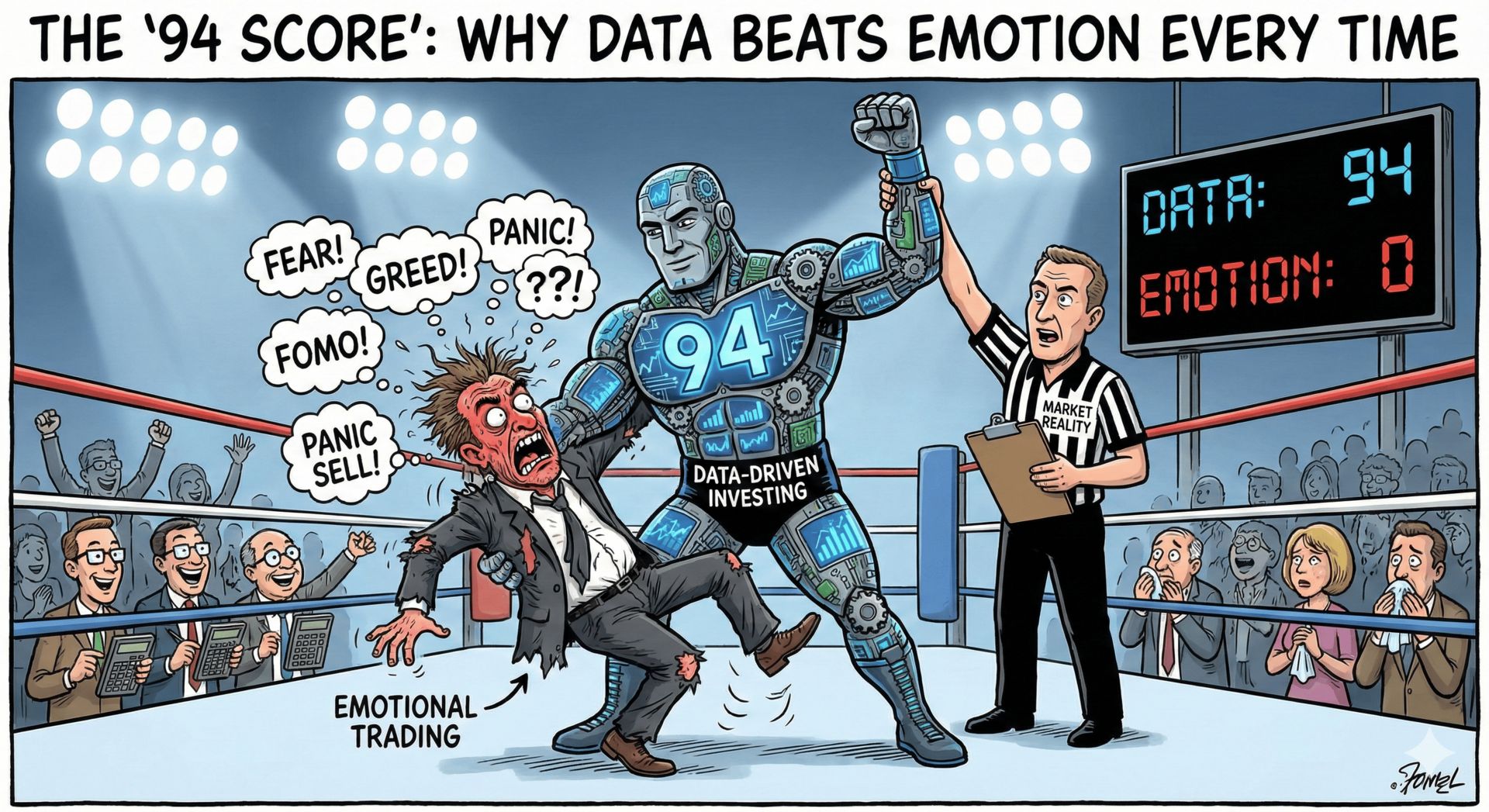

🐳 The "94 Score": Why Data Beats Emotion Every Time

Let’s talk about how the "Ownership Class" picks stocks versus how the "Employee Class" picks stocks. The Employee picks stocks based on Stories. "I like my iPhone, so I'll buy Apple." "Everyone is talking about ChatGPT, so I'll buy Nvidia."

The Owner picks stocks based on Systems. We don't care about the story. We care about the Metrics. We use "Quantitative Analysis" (Quant) to strip away the emotion and look at the raw health of the business.

The "Black Box" of Investing

Whitney Tilson’s system is essentially a "Quant Model." It likely looks at dozens of factors:

Cash Flow Velocity: Is the company generating cash faster than it spends it?

Valuation Multiples: Is it cheap relative to its growth rate (PEG ratio)?

Momentum Signals: Is the "Smart Money" quietly accumulating shares before the public notices?

When a system like this spits out a 94 out of 100, it’s a statistical anomaly. It means the stars have aligned. It means the stock is fundamentally superior to 94% of the market, yet likely trading at a price that doesn't reflect that quality yet.

The "Stealth" Factor

Why is this AI stock "stealthy"? Because the media hasn't ruined it yet. When a stock is on the front page of the Wall Street Journal, the "Alpha" (the profit potential) is usually gone. The price has already been bid up by the crowd. The real money is made in the "Discovery Phase" - finding the stock after the Quant system flags it, but before the Jim Cramers of the world start shouting about it.

The "Second Wave" of AI

We are entering "Phase 2" of the AI boom. Phase 1 was the "Hardware Phase" (Nvidia chips). That trade is crowded. Phase 2 is the "Application Phase" (The software and tools that actually use the chips to make money). This hidden stock is likely a key player in this second wave. It’s the company that will turn the raw computing power into business profits.

Whale's Verdict

I respect Whitney Tilson because he admits when the market is irrational. Calling for a pivot away from Nvidia right now is unpopular. It’s controversial. But in investing, "Unpopular" is usually where the money is. If you want to feel good, buy what everyone else is buying. If you want to get rich, buy what the system says is a 94/100.

If you've read this far, you're definitely my kind of person. You rely on data, not hype. Here is the link again to see the system and the ticker

|

Sponsored Content

Top Picks from Partners We Trust

|

How do you pick your stocks?

Your feedback is important to us. Here are the results of yesterday's poll:

12/14 Poll - The "Chatbot" hype is cooling. What is the next bubble?

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|