📈 The "Blind Capital" Crisis: Why Fortune 1000 Giants Are Panic-Buying AI

Hello friends, Mr. Whale again here.

If you want to understand where the "Smart Money" flows, you have to look for inefficiency. Wherever there is waste, there is a "Whale" waiting to eat it.

For the last twenty years, the biggest waste in the global economy has been Advertising. The old adage says, "Half the money I spend on advertising is wasted; the trouble is I don't know which half."

For a long time, companies accepted this. They threw millions of dollars at Google and Facebook, hoping their ads would land in front of a real human who actually cared. We call this the "Spray and Pray" method. It’s how the "Little Fish" operate.

The "Signal Loss" Crisis

But the game has changed. Privacy laws (GDPR) and tech updates (Apple's iOS changes) have blinded the old tracking systems. The "Spray and Pray" model is broken. Fortune 1000 brands are suddenly flying blind. They are spending millions to show ads to bots, click farms, and people who have zero interest in their products.

This has created a Trillion-Dollar Panic in the boardroom. And where there is panic, there is opportunity.

The "Sniper" Solution

We are witnessing a massive capital rotation out of "Legacy AdTech" and into "Predictive AI." The "Big Fish" aren't guessing anymore. They are using military-grade intelligence to find their customers.

We are tracking a company that is being called the "ChatGPT of Marketing." Instead of relying on outdated cookies, it uses AI to scan the open web—TikTok, Reddit, blogs—to identify the "perfect audience" based on behavior and emotion.

It turns the "Shotgun" of advertising into a "Sniper Rifle."

The Proof is in the Contracts

In my world, we don't look at pitch decks. We look at Recurring Revenue. This company isn't a science experiment. It is already securing seven-figure contracts with the biggest names in entertainment, healthcare, and gaming. When a Fortune 1000 giant signs a check that big, it means the software works. It means the ROI is undeniable.

This is the kind of infrastructure play that usually stays private until it hits a $10 Billion valuation. But right now, there is a breach in the wall.

By the way, usually, you need to be a venture capital insider to get access to a pre-IPO deal with backing from Adobe and Meta alumni, but I found the regulatory door that lets you in at the ground floor

Continued for those who want to understand the exit strategy.

🐳 The "Pre-IPO" Game: Buying the Ticker Before It Exists

Let’s talk about how the "Ownership Class" makes money versus how the "Employee Class" makes money. The Employee works for a salary. The Owner buys equity for pennies and sells it for dollars.

The "J-Curve" of Private Equity

When a tech company goes public (IPO), the chart usually looks like a hockey stick.

Seed Round: $0.01

Growth Round: $0.50 - $1.00

IPO Price: $15.00+

The "Delta" (the difference) between the Growth Round and the IPO is where generational wealth is created. By the time the ticker hits the screen on CNBC, the easy money has been made. The "Whales" are selling to the "Retail" investors.

The "RAD" Intel Setup

We are looking at a specific opportunity with RAD Intel that fits the "Whale Criteria" perfectly.

1. The "Reserved" Ticker Signal They have already reserved the Nasdaq ticker symbol $RADI. Companies do not do this for fun. It is a legal and administrative step that signals Intent. It means the roadmap leads to a public listing. As an investor, you want to see a clear path to liquidity. The reserved ticker is that path.

2. The "Valuation" Reality The shares are available at $0.85. In the world of AI SaaS (Software as a Service), valuations are often 20x revenue. Getting in at a sub-$1 price point provides Asymmetry. The downside is capped (you lose $0.85), but the upside is uncapped (multiples of return).

3. The "Institutional" Validation Retail investors look for "Hype." Whales look for "Partners." RAD Intel is backed by Adobe. They have insiders from Meta, Google, and Amazon involved. These are people who know the ad industry is broken. They know the "Cookie" is dead. And they are betting their reputations and capital on this AI solution. That is the kind of validation that de-risks the trade.

The "Second Shot"

The promo asks: "Missed Nvidia? Missed Shopify?" The reason most people missed them wasn't lack of intelligence. It was lack of Access. You couldn't buy Nvidia when it was a private startup. But Regulation A+ (Reg A+) has changed the rules. It allows you to step into the deal alongside the venture capitalists.

Whale's Break

The market rewards those who solve the biggest problems. Right now, the biggest problem in business is: "How do I find my customer without wasting money?" RAD Intel has the answer. And for a limited time, you can own a piece of the answer.

Whale's Final Word

The window to invest at $0.85 is a function of the current funding round. It is not permanent. Once the company moves closer to the IPO, the valuation will re-rate. If you want to sit at the table with the Big Fish, you have to buy before the dinner bell rings.

If you've read this far, you're definitely my kind of person. You hunt for value where others fear to tread. Here is the link again to verify the ticker and the price

|

Sponsored Content

Top Picks from Partners We Trust

|

🐳 Mr. Whale asks: Do you feel "Late" to big tech stocks like Nvidia?

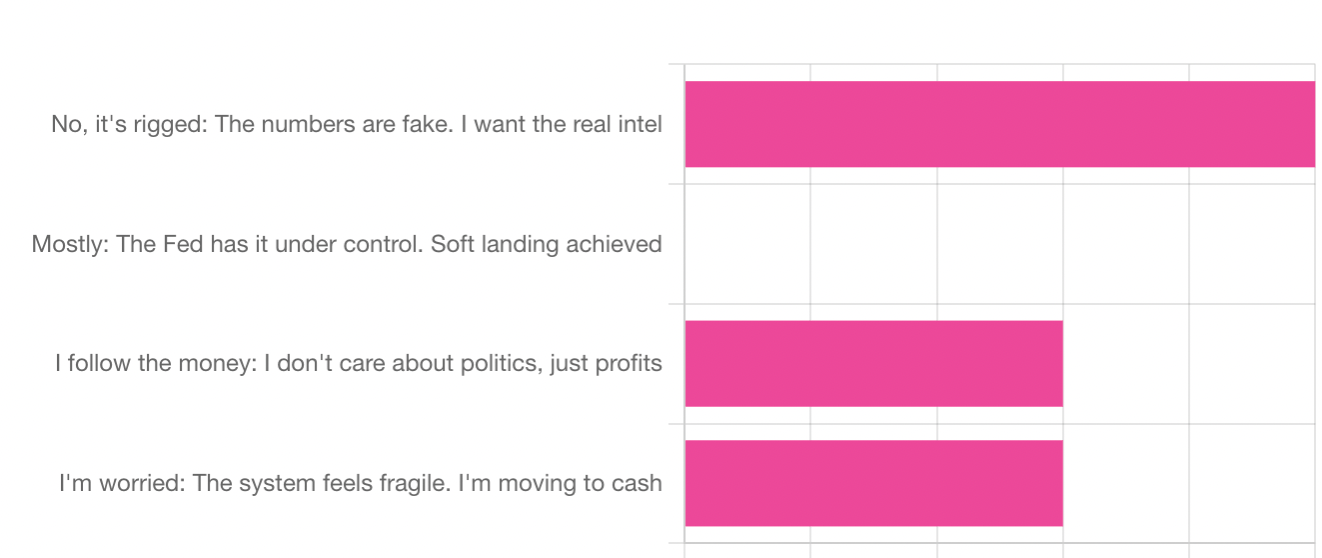

Your feedback is important to us. Here are the results of yesterday's poll:

12/12 Poll - Mr. Whale asks: Do you trust the "Official Narrative" on the economy?

The Gold standard for AI news

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|