📈 The "AI Displacement" Trade: Why Smart Capital is Betting Against the Old Workforce

Hello friends, Mr. Whale here.

On the trading floor, we have a saying: "Don't listen to what they say. Watch what they hedge."

A prominent tech leader recently issued a warning that AI will reshape the workforce faster than most people expect. The media treated this as a scary headline about job losses. But in the institutional world, we don't get scared. We get positioned.

We are witnessing a Structural Displacement.

This isn't just about ChatGPT writing emails. This is about "Industrial AI" replacing entire departments. Marketing, creative operations, data analysis - these used to be "human-heavy" cost centers. Now, they are becoming "software-heavy" profit centers.

The "Little Fish" vs. "Big Fish" View

The Little Fish worries: "Will AI take my job?"

The Big Fish asks: "Who owns the AI that is taking the jobs?"

This is the difference between being labor and being capital.

The "Whale Trade" right now is identifying the specific AI platforms that are actually delivering ROI (Return on Investment) to the Fortune 1000. We aren't interested in the hype. We are interested in the SEC filings. We want to see the numbers.

The "ROI" Signal

We’ve been tracking a company called RAD Intel. While everyone else is playing with chatbots, these guys have built a predictive intelligence system that is already embedded in major Fortune 1000 brands.

They aren't selling "fun." They are selling efficiency. They help brands eliminate waste in their marketing budgets by predicting exactly what content will drive action. This isn't speculation; it is creating measurable ROI.

When a company can prove that its AI saves a corporation millions of dollars, that software becomes "Sticky." It becomes infrastructure.

The "Pre-IPO" Window

Usually, infrastructure plays like this are locked up by the venture capitalists on Sand Hill Road. By the time you see the ticker symbol on CNBC, the valuation is already in the billions. The "easy money" has been made.

But RAD Intel represents a structural anomaly. They have already reserved their Nasdaq ticker ($RADI). They have audited financials and SEC filings. But they are still allowing early access via a Regulation A+ offering at $0.85 a share.

This is a rare opportunity to buy the "displacement engine" before it hits the public markets.

By the way, usually, you need to be an institutional LP (Limited Partner) to get access to pre-IPO deal flow with this kind of Fortune 1000 validation, but I found the regulatory loophole that opens this door to you right now

Continued for those who want the masterclass (Now let's get back to the trade mechanics).

🐳 The "Ownership Class" vs. The "User Class": How to Position for the Disruption

We need to have a serious conversation about Economic Transformation.

In every major technological shift - the Steam Engine, the Internet, the Mobile Phone - society splits into two groups.

The Users: People who use the technology to do their job (or lose their job to it).

The Owners: People who own the equity in the technology itself.

The "Users" always struggle. They fight for wages. They worry about automation. The "Owners" always win. They capture the productivity gains.

If AI allows one person to do the work of ten people, the "User" class sees wage compression. But the "Owner" class sees a 10x increase in margin.

The "RAD Intel" Case Study

Let’s look at RAD Intel through this lens. They are building the brain for digital marketing. They utilize AI to scan the open web (TikTok, Reddit, Blogs) and predict customer behavior.

The Disruption: They replace the "guesswork" of human marketing teams with the "precision" of AI.

The ROI: Fortune 1000 brands pay them recurring 7-figure contracts because the software works. It makes money.

As an investor, you don't need to understand the code. You need to understand the Capital Flow. Money is flowing OUT of inefficient, human-heavy advertising agencies. Money is flowing INTO efficient, AI-driven platforms like RAD.

The "Asymmetric Upside" of $0.85

In my private analysis, I look for Asymmetry.

Downside: You lose your principal (always a risk in private markets).

Upside: You own equity in a platform that is reserving a Nasdaq ticker ($RADI) and scaling with Adobe-backed tech.

When you buy a public stock like Nvidia at $130, you are buying "Perfection." The market has already priced in the success. When you buy a private stock like RAD Intel at $0.85, you are buying "Discovery." You are buying before the market has fully priced in the transformation.

Whale's Break

The workforce is changing. You can't stop it. Your only defense is to own the thing that is causing the change. Don't just use AI. Invest in it. Own the infrastructure.

Whale's Final Word

The window to buy at $0.85 is a function of the Regulation A+ offering. It is not permanent. Once the S-1 is filed and the IPO process begins, the pricing dynamics change completely. If you believe AI is real, and you believe it will disrupt the Fortune 1000, you need exposure to the companies making it happen.

If you've read this far, you're definitely my kind of person. You understand that in a gold rush, you don't dig - you sell the shovels. Here is the link again to check the offering circular and the $0.85 price point

|

Sponsored Content

Top Picks from Partners We Trust

|

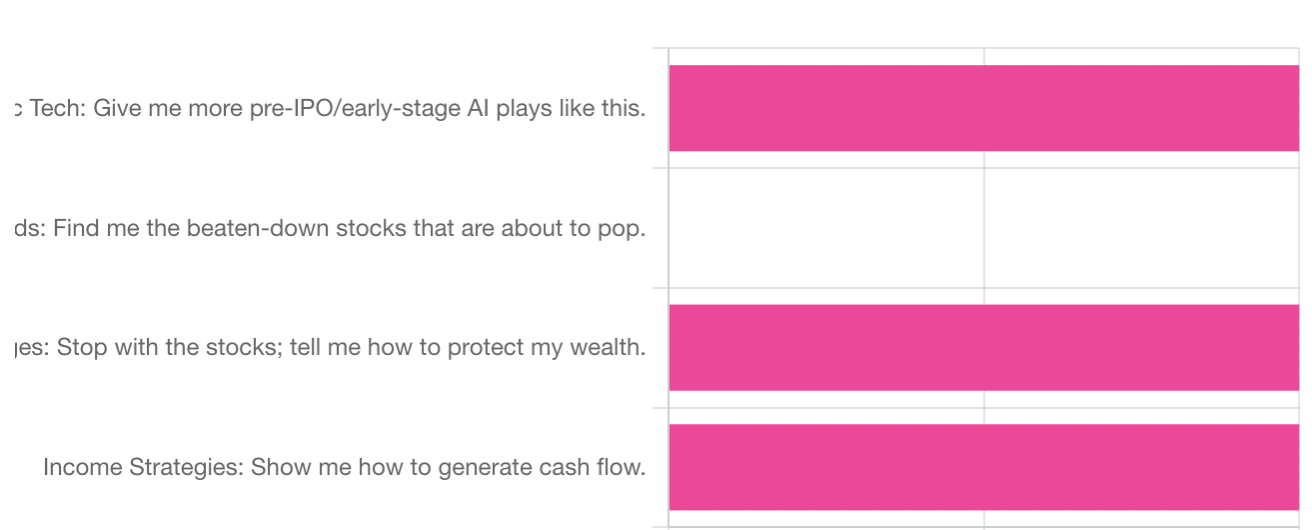

Where do you want to hunt for the next 10x?

Your feedback is important to us. Here are the results of yesterday's poll:

12/09 Poll - Question: Where should Mr. Whale point the radar next?

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|