The rain is hitting the floor-to-ceiling windows of my office like a rhythmic interrogation. Outside, the city is a blur of neon and grey, a frantic hive of retail traders chasing the latest AI-generated ghost. In here, the only light comes from the twin glow of the Bloomberg terminal and the amber glint of a neat Highland Park.

The screen doesn't lie. It doesn't have an agenda. It only has flows.

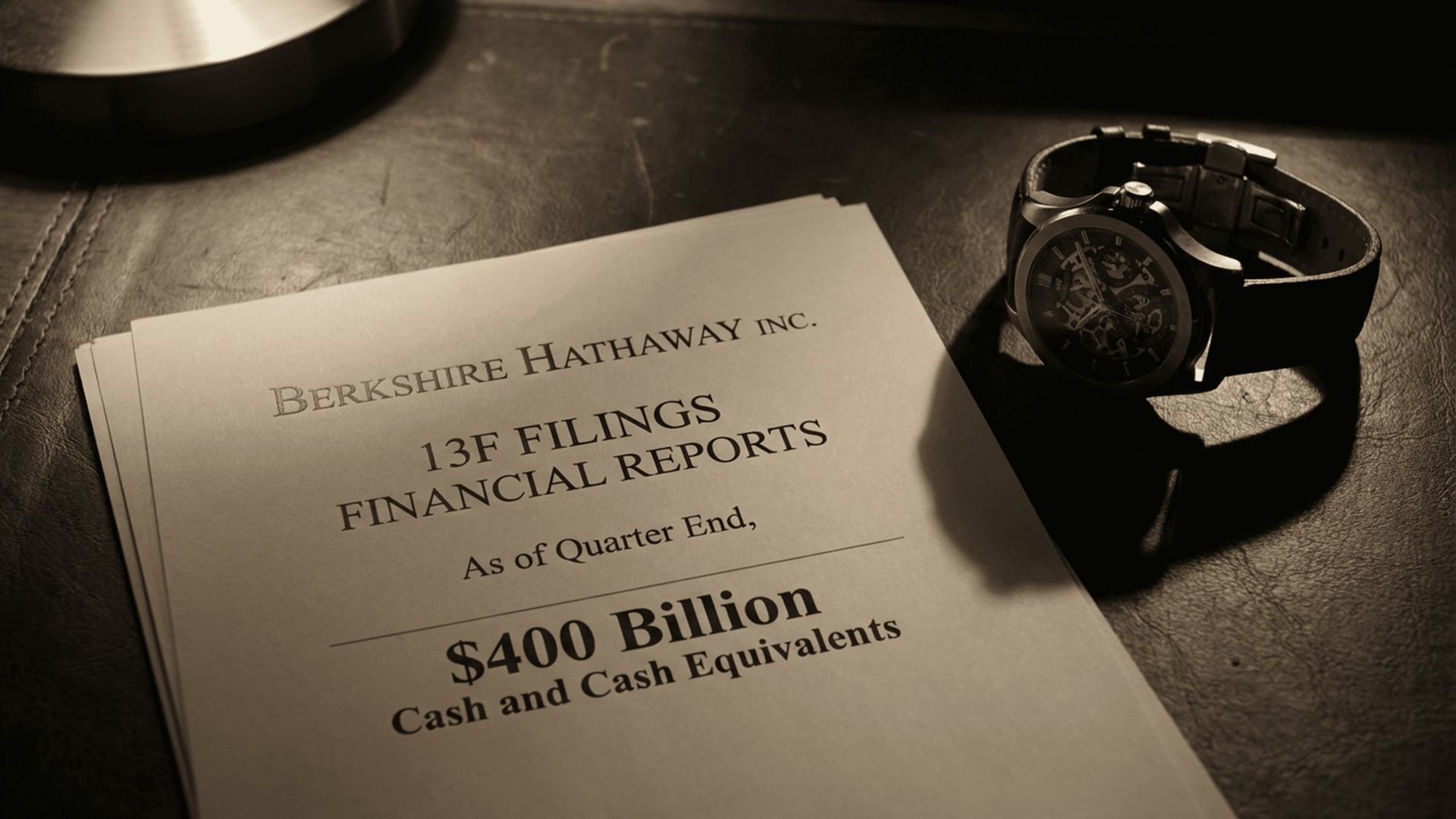

For decades, the herd looked to Omaha for a sign of "confidence." They wanted a grandfatherly smile and a cherry coke. What they got instead this month was a cold-blooded execution. The numbers hit the wire like a series of gunshots: $400 billion in cash. A record. A monolith. A tombstone for the bull market.

While the "Them" - the retail crowd - scramble for scraps in the tech sector, the "Us" - the Whales - are watching the greatest liquidation in corporate history. Warren Buffett didn't just step down as CEO; he left the building after setting the furniture on fire. He didn't leave Greg Abel a portfolio. He left him a War Chest and a map of a minefield.

We are no longer in an accumulation phase for equities. We are in a Monetary Regime Change.

The $400 Billion Warning Shot

The math is brutal. According to the latest filings from TradingView and NASDAQ, Berkshire Hathaway’s cash reserves have ballooned to $400 billion. To put that in perspective, that is more than the GDP of most sovereign nations. It is a hoard that has grown from a mere $100 billion in early 2023.

The herd thinks this is "dry powder." They think the Oracle is waiting for a "deal."

They’re wrong. This isn't preparation for a purchase. This is a Liquidation.

Look at the Apple stake. It was the crown jewel. A $200 billion fortress. In a series of calculated moves, it has been gutted, slashed down to $60 billion. When a Whale like Berkshire dumps $140 billion of the world’s most recognizable stock, they aren't "rebalancing." They are fleeing a burning building. They are extracting Shadow Liquidity before the doors lock.

The transition to Greg Abel isn't just a change in nameplates. It is the end of the era of "Value Investing" and the beginning of the era of Sovereignty. Buffett has spent five consecutive quarters avoiding share repurchases. Think about that. He won't even buy his own company. He views Berkshire’s own stock as a toxic asset at these valuations.

The Logic of Desperation is clear: when the smartest man in the room refuses to buy his own shares, and instead hoards Short-Term Treasuries yielding a measly 3.6%, he is telling you that the risk-free rate is the only "safe" yield left in a crumbling system. He is choosing a 3.6% "bribe" from the government over the volatility of a market that has decoupled from reality.

The Arbitrage of Fear

The mechanism here is simple: Arbitrage. But it’s not the kind of arbitrage you learn in an MBA program. It’s the arbitrage of survival.

Berkshire is currently yielding roughly 3.6% on Treasuries. To the retail crowd, that sounds like a joke. They want 1000% gains on AI-tokens. But to a Whale, 3.6% on $400 billion is $14.4 billion a year in "risk-free" cash flow. That is a War Chest that grows while the rest of the market enters a Churn phase.

While the mainstream media (CNBC) screams about the "AI Boom," the actual data from NASDAQ shows Buffett has largely avoided AI-focused equities. He even kept his Alphabet stake minimal. Why? Because he understands the Reserve Cliff. We are at the end of a cycle where "Soft Economy" promises are being crushed by "Hard Asset" realities.

Buffett isn't just avoiding tech; he’s retreating from his traditional strongholds. He has trimmed or completely exited positions in Bank of America and other financials. This is a selective retreat. He is starving the financial system of his capital because he knows the Sovereign assets are the only things that will survive the coming Monetary Regime Change.

Front-Running the Pivot

The execution strategy for the elite circle is no longer about "buying the dip." It is about Institutional Accumulation of assets that have intrinsic, defensive value.

When the 13F filing drops on February 17th, the world will see where that $400 billion started to move. But by then, the "Arbitrage" will be gone. The price will have moved. The Whales are already positioning.

As AInvest reports, Berkshire’s cash position reflects a disciplined capital allocation that mirrors his 2008 financial crisis playbook. He is waiting for Market Dislocations. He is waiting for the moment when the "Them" realize that their digital wealth is built on a foundation of sand.

But there is a bigger threat than just market volatility. There is the threat of the system itself.

The Final Play: Extracting Sovereignty

The endgame is clear. We are witnessing a Corporate Warfare strategy of starvation. By hoarding $400 billion, Berkshire is effectively removing that liquidity from the reach of the "Herd." They are creating a vacuum.

When the Reserve Cliff arrives, and the 3.6% yield on Treasuries no longer covers the cost of a collapsing dollar, that $400 billion will move into Hard Assets. It won't go into "Soft" tech. It will go into the ground. It will go into the miners that control the world’s most ancient form of wealth.

The institutional lexicon doesn't use the word "hope." We use the word Positioning.

You have a choice. You can follow the mainstream narrative - the "Them" - and wait for the 13F filings to tell you what happened three months ago. Or you can look at the Balance Sheets now. You can see the liquidation of Apple. You can see the exit from Bank of America. You can see the five quarters of zero buybacks.

The Oracle has left the building. Greg Abel is sitting on a mountain of cash. The system is signaling a total Monetary Regime Change.

Don't be the exit liquidity for the $400 billion liquidation. Be the one who front-runs the pivot. Extract your capital from the treadmill. Seek sovereignty.

The whiskey is gone. The terminal is still red. The rain hasn't stopped.

But for the first time in a long time, the path is clear.

Stay sharp. Stay cynical.

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|