Consumer Rewards Cards Peak in Late 2025 - Targeted Cash Back and Instant Bonuses Reshape Spending Optimization

December 28, 2025 - the post-holiday data rolls in, confirming another year of robust consumer activity despite headwinds.

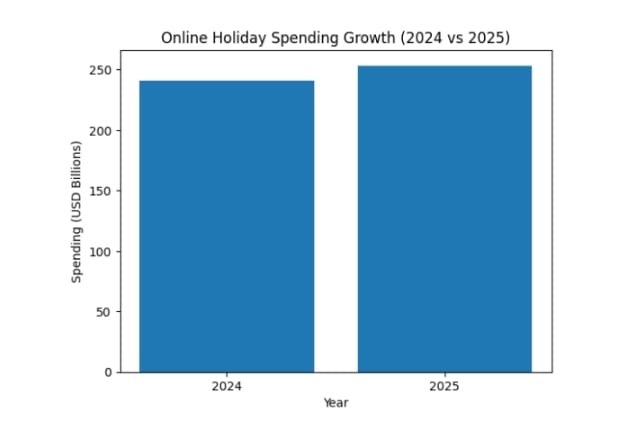

Online platforms captured record volumes.

Same-day delivery, bundled services, personalized recommendations - all reinforcing ecosystem stickiness.

Rewards credit cards emerge as key optimization tool.

Offers emphasize high category returns, instant welcome bonuses, streamlined approvals.

For frequent buyers in groceries, online retail, dining, fuel - hundreds or thousands annually in effective savings.

The structure appeals straightforwardly.

No complex point systems for core benefits.

Statement credits or direct deposits reduce net spend.

In environment where essentials remain elevated, perceived yield matters.

Consumers increasingly calculate effective cost after rewards.

Current Offer Mechanics and Value Proposition

Leading cards deliver compelling math.

Category bonuses - 5% or higher on select spend - unlimited in many cases.

Flat rates 2-3% elsewhere.

Welcome bonuses - $100-$300 range - credit instantly upon approval.

No annual fees on top programs.

Digital applications leverage existing data for decisions in minutes.

Targeted outreach hits high-potential users precisely.

Heavy shoppers see rapid payback.

Similar structures across retailers, travel, general cash back.

Rotation calendars, custom categories add flexibility.

Mobile apps track progress, suggest redemptions.

Friction minimized.

2025 spending patterns show adaptation.

E-commerce penetration deepens post-pandemic.

Convenience trumps price hunting for time-constrained households.

Grocery delivery, subscription services embed in routines.

Rewards offset perceived premium.

Inflation psychology lingers - even as rates ease, memory of peaks influences choices.

Budget discipline rises.

Tools proving incremental savings win loyalty.

Younger demographics lead optimization - stacking cards, tracking portals.

40+ cohorts follow as fixed costs pressure discretionary spend.

Retirement drawdown phase heightens yield sensitivity.

Digital Underwriting and Approval Speed

Fintech advances accelerate decisions.

Machine learning assesses risk from alternative data.

Banking history, spending patterns, platform relationships inform models.

Instant approvals common for qualified applicants.

Welcome bonuses incentivize immediate adoption.

No waiting periods for core earning.

Friction removal drives conversion.

Personalization and AI Integration

Recommendation engines suggest optimal cards.

Spending analysis identifies missed categories.

Platforms partner with issuers for seamless applications.

Data loops refine targeting.

Offers align with actual behavior.

Privacy considerations shape implementation.

Consent-based sharing, transparent usage.

Broader Economic Context

Wage growth moderates.

Savings rates stabilize.

Credit card balances rise selectively.

Delinquency ticks up in subprime but remains contained overall.

Rewards programs retain prime borrowers.

Interchange revenue funds incentives.

Flywheel sustains.

Competitive Intensity

Issuers differentiate on categories, redemption ease, partnerships.

Co-brand cards lock ecosystem spend.

General cash back challengers offer flexibility.

Travel recovery boosts premium perks.

Balance transfer offers compete for share.

Consumers benefit from variety.

Optimization communities share strategies.

Practical Optimization Framework

Track actual spend by category.

Match highest returns.

Utilize welcome bonuses sequentially.

Pay balances full to avoid interest.

Monitor credit utilization.

Annual review for better offers.

Math straightforward for disciplined users.

Late 2025 promotions aggressive.

Holiday spend amplifies bonuses.

New year resolutions often include financial tuning.

Timing aligns.

Capital markets recognize durability.

Recurring revenue from engaged cardholders.

Interchange stable despite debates.

Fintech extensions expand moats.

More on institutional perspective in part two.

But signals consistent.

Rewards cards deliver real offset for aligned spend.

Ecosystem integration deepens.

Optimization compounds.

Long-Term Value Creation Mechanics

Cash back represents strategic investment.

Higher lifetime value from loyal cardholders outweighs immediate payout.

Data from spending patterns refines product offers.

Personalization increases basket size, frequency.

Ecosystem partnerships consolidate flows.

Co-brand arrangements lock category spend.

General issuers compete on flexibility, redemption ease.

Flywheel effects compound.

Retention above industry averages.

Net revenue retention expands with cross-sell.

Capital markets reward predictability.

Broader Fintech Integration Trends

Big platforms extend beyond core retail.

Payments, lending, insurance, banking services.

Rewards cards serve as entry point.

Seamless applications within apps.

Instant bonuses drive conversion.

Data advantage enables superior underwriting.

Risk pricing improves.

Default rates contained in prime segments.

Regulatory navigation key - interchange caps debated, data privacy enforced.

Platforms with transparent practices position better.

Consumer Credit Dynamics

Balances grow selectively.

Revolving debt rises in lower tiers.

Prime borrowers utilize for rewards, pay full.

Interest avoidance preserves value.

Optimization communities proliferate.

Strategy sharing - bonus churning, category stacking.

Issuers counter with anti-abuse measures.

Sustainable users rewarded.

Market Performance and Capital Allocation

Fintech names hold valuation floors on recurring metrics.

Payment volume growth, take rates stable.

Consumer discretionary sensitivity balanced by necessity spend.

Holiday 2025 confirmed resilience.

Post-peak data shows continued engagement.

Institutional additions in select names.

Broader mandates increase exposure.

Some hedge concentration with tangible assets.

Precious metals attract during narrative peaks.

Historical diversification pattern.

Regulatory and Risk Overlay

Interchange fee legislation pending. Potential caps impact revenue.

Platforms lobby for balance. Data usage scrutiny intensifies.

Consent, portability requirements evolve. Ethical targeting - avoiding exploitation.

Bias audits gain traction. Compliance investment rises. Long-term winners align early.

Competitive Response and Innovation

Traditional banks enhance digital offers.

Challenger brands differentiate on user experience. Premium travel cards rebound with borders open. Cash back simplicity appeals broadly.

Custom category choice features spread. Redemption flexibility - travel transfer, statement credit, gift cards. User retention improves.

Practical Considerations for Users

Align card with actual spend patterns. Avoid interest through full payment. Monitor credit score impact.

Utilize bonuses responsibly. Review annually for superior offers. Math transparent for disciplined approach.

Institutional Outlook Entering 2026

Growth moderates but persists. Digital wallet adoption accelerates. Embedded finance expands.

Rewards remain core retention tool. Capital favors scaled operators with data moats. Risks managed through diversification.

Concentration prompts balance.

Bottom Line

Late 2025 rewards card promotions reflect consumer responsiveness.

High cash back structures deliver tangible offset. Ecosystem integration deepens convenience.

Fintech extensions expand reach. Capital recognizes durability.

Regulatory evolution shapes path. Clear-eyed users optimize where value clear. Track evolving landscape.

Signals favor continued emphasis on rewards. Consumer finance digitizes further. Position accordingly.

What you think about one more daily post?

|

Sponsored Content

Top Picks from Partners We Trust

|

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|