Looking Beyond the Screen

Hello again. It’s good to be back with you.

If you’ve been following the markets lately - or even just watching the evening news - you know that Artificial Intelligence (AI) is the only thing anyone wants to talk about. It’s exciting stuff. We see programs writing poetry, creating incredible images from scratch, and solving complex problems in seconds. It truly feels like magic.

And because it feels like magic, investors have been rushing into anything that even mentions "AI." Stocks of chipmakers and software companies have gone vertical. It’s understandable. People naturally don't want to miss out on what looks like the next big technological revolution.

But here at Whales Investing, we like to take a step back. When everyone is rushing to one side of the boat, we prefer to stand in the middle and look at the horizon. We ask the simple, practical questions that often get lost in the noise and hype of a bull market.

The most important question right now isn't which chatbot is smarter. It is this: If AI is the "brain" of the future, what is the "heart" that keeps it beating?

The answer is surprisingly simple, yet profoundly impactful: electricity. Massive, nearly unimaginable amounts of reliable, constant electricity.

We sometimes forget that the "digital cloud" isn't actually hanging in the sky. It lives on the ground, in gigantic, sprawling buildings filled with racks of servers that run hot, twenty-four hours a day, seven days a week. These artificial brains get very thirsty for power. Every time we ask an AI model to do something, physical energy is consumed in a data center somewhere in the world.

The "Virginia Problem" and the Energy Crunch

To understand the scale of this looming challenge, we don't need to look far. Let's look at Northern Virginia. It’s often called "Data Center Alley." Due to its location to internet backbones, more of the world’s online traffic flows through that small patch of land than almost anywhere else on earth.

For years, local utility companies were happy to hook up new data centers to the grid. Business was booming, developers were happy, and the tax revenue was flowing. But recently, they’ve had to tap the brakes hard. Why? Because the power grid simply cannot keep up. The transmission lines are practically glowing red; they are maxed out. There just isn't enough "juice" to go around anymore.

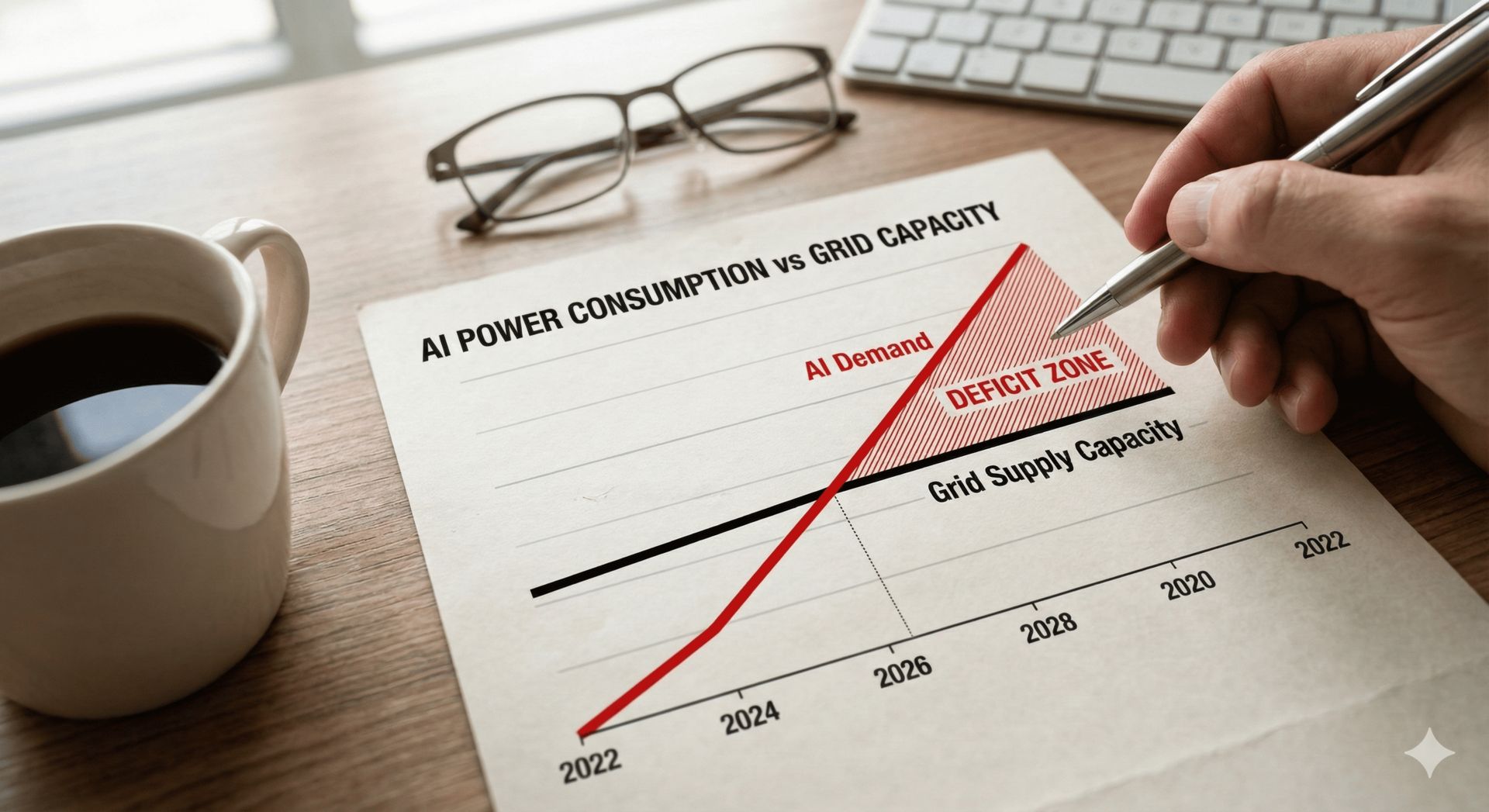

And here is the critical part: this crunch happened before the generative AI boom really took off.

Think about this comparison. A standard Google search is incredibly efficient. But an AI search - like asking ChatGPT to write a paragraph or summarize a document - uses significantly more electricity. Some estimates suggest it's 10 times more per query. Now, multiply that by billions of queries a day as this technology gets integrated into every phone and laptop. Then, add in the massive "training runs" where supercomputers crunch data for months to make the models smarter.

We are facing a physical reality check. We are trying to build a 21st-century Star Trek economy on a 20th-century power grid designed for lightbulbs, refrigerators, and standard office buildings. The math simply doesn't work anymore.

What the "Whales" See

This physical constraint is where the smart money - the "Whales" we track - is focusing their attention right now. They know that the chip shortage will eventually be solved by building more factories. The software will get more efficient over time. But the need for baseload power - power that is on all day, every day, regardless of the weather - is the ultimate bottleneck.

In economics, the most valuable commodity is the one that is essential but scarce. Right now, reliable electron delivery is becoming the scarcest resource in the tech world.

If you are a tech giant building a multi-billion dollar AI data center, you cannot afford a brownout. A loss of power can mean corrupted data and millions of dollars in losses in seconds. You need guarantees. This is why we are starting to see unprecedented moves, with tech companies quietly cutting deals directly with power producers, trying to secure their own energy future independent of the public grid.

The Whales aren't just buying the stocks that make the headlines today. They are positioning capital into the physical infrastructure that makes the future possible. They know that without a massive, trillion-dollar upgrade to our energy systems, the AI revolution hits a brick wall. This isn't a sexy software play that doubles overnight. This is a foundational, multi-decade shift in how our physical world works to support our digital aspirations.

The New Value in "Old" Places

When you see something like Jeff Brown’s investigation in Kemmerer, Wyoming, mentioned above, it connects the dots perfectly. Why would the future of high-tech energy be happening in a "forgotten coal town" in the high desert?

It actually makes perfect sense from an infrastructure perspective. These towns already have something that is incredibly difficult, expensive, and time-consuming to build from scratch: massive grid connections. They have huge transmission lines already in place that used to carry gigawatts of power from coal plants to the rest of the country.

As old coal plants are retired, those transmission lines sit empty. As we move toward cleaner, more dense forms of energy - whether that's advanced nuclear (like the projects proposed for Kemmerer), geothermal, or next-generation natural gas - it is much easier to plug these new technologies into the existing highway system of wires than to try and build new power lines across hundreds of miles of private land.

This is the "Great Energy Transition" in action. It’s not just about putting up solar panels in a field. It’s about finding sources of power that are as reliable as coal used to be, but clean enough for the future, and dense enough to feed the insatiable appetite of AI.

Density is Destiny

We need to have an honest conversation about "power density." A solar farm needs thousands of acres of land to generate the same amount of power as a single traditional power plant that fits on a few city blocks.

Data centers love density. They want a massive amount of power delivered to a small footprint, 24/7 without interruption. The wind doesn't always blow, and the sun goes down every night. That intermittency is a problem for an AI server that can never sleep.

This is why the Whales are looking seriously at the resurgence of nuclear technology, advanced battery storage at grid scale, and cleaner ways to utilize natural gas. These are the adults in the room of energy solutions. They aren't ideological; they are practical. They provide the reliable baseload power that a modern digital economy demands.

The investment opportunity here is profound. We are talking about the re-industrialization of America’s power base. It’s a physical build-out of epic proportions - involving concrete, copper, steel, and advanced technology.

How Whales Play the Long Game

So, how do we translate this massive macro trend into a portfolio strategy?

The first rule of Whales Investing is patience. We don't chase the daily wiggles of the stock market or the latest meme stocks. We identify inevitable long-term trends and position ourselves in the path of progress.

The energy transition is inevitable. The AI demand for power is inevitable.

Therefore, the companies that own the grid, the companies that build the new reactors, the utility giants that have the government contracts and rights-of-way, and the miners that supply the copper for the wires - these are the bedrock holdings for the next decade.

Many of these are "boring" companies. They pay dividends. They move slowly. They don't make headlines on social media. But when the tech sector has a correction because investors realize the power isn't there yet, these infrastructure stocks are the ones that hold up. They are the foundation.

We are looking for businesses with "moats" around them - regulatory approvals that are hard to get, existing infrastructure that costs billions to replicate, and specialized technical knowledge that takes decades to acquire. You can't just spin up a competitor to a major power transmission company overnight in your garage.

A Final Thought on Real Wealth

Ultimately, investing like a Whale means understanding that money is just a claim on real-world resources. In a world that is increasingly digital, the most valuable things are becoming incredibly physical. Real power, real infrastructure, real solutions to physical problems.

By focusing on the energy foundation of the AI revolution, rather than just the software applications, you are taking a smarter, safer, and potentially more lucrative path. It’s not as flashy as picking the next hot tech stock, but it’s much more likely to help you build lasting wealth for yourself and your family over the long haul. Keep it simple, focus on the essentials, and always look at the physical reality behind the digital story.

|

Sponsored Content

Top Picks from Partners We Trust

|

The "Power Foundation" Watchlist:

XLU (Utilities Select Sector SPDR Fund): The easiest, broadest way to own the bedrock utility companies of America. Boring, reliable, and pays a steady dividend while you wait for the build-out.

ETN (Eaton Corporation): A massive industrial player that makes the heavy-duty electrical equipment - switchgear, transformers, power management - needed inside data centers and on the grid.

NEE (NextEra Energy): A unique giant that combines a stable traditional utility in Florida with the world’s largest renewable energy development business. A prime example of the transition in action.

URA (Global X Uranium ETF): If projects like the one in Kemmerer are the future of baseload power, this ETF gives broad exposure to the fuel cycle needed to run them.

GRID (First Trust Nasdaq Clean Edge Smart Grid ETF): Focuses specifically on the companies building the modern grid hardware, smart meters, and technology needed to manage complex power flows.

Bottom Line

The digital future is totally dependent on physical power. The AI boom is incredibly exciting, but it is creating an energy crisis that can only be solved with massive investment in new, real-world infrastructure. The smartest money in the world is moving into this boring, essential sector right now. Don't get distracted by the hype; focus on what makes the hype possible. Building wealth is a marathon, not a sprint, and the companies that keep the lights on are the ones that will finish the race.

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|