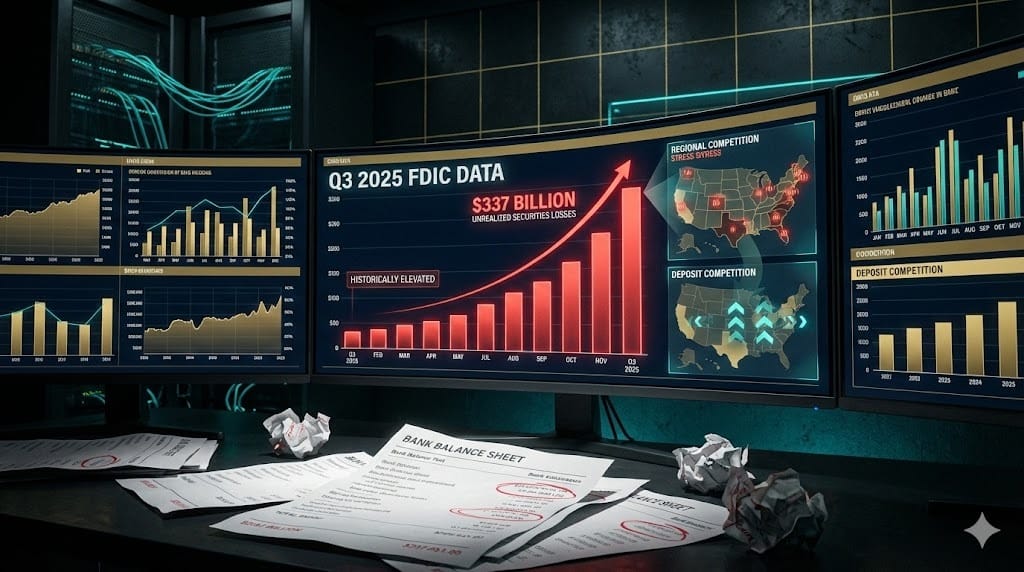

U.S. banks reported $337 billion in unrealized securities losses for Q3, per FDIC data released earlier this month. That's the 14th consecutive quarter above historical averages, even if the total has trended lower from cycle peaks.

Funding pressures haven't fully eased. Deposit costs stay high as competition for liquidity continues. Commercial real estate portfolios remain a watch item, especially for mid-size and regional institutions.

No flashing red crisis indicator across the board. But the underlying sensitivities are still there.

The Persistent Weight of Unrealized Losses

The $337 billion figure marks meaningful improvement - down roughly 15% year-over-year as higher-yielding assets gradually replace older low-rate holdings.

Context is key, though.

These mark-to-market hits tie up capital that could otherwise support lending or buffer shocks. Smaller banks feel it more acutely; larger ones have greater capacity to hold to maturity.

Deposit flows show the same story: money chasing yield, shifting to money market funds or alternatives when rates or confidence move.

Recent headlines on isolated fraud cases or CRE delinquencies serve as reminders - the system handles them, but not without friction.

How Resolution Tools Actually Work

Regulators have clear playbooks for stress events.

FDIC resolution frameworks prioritize insured deposits - $250,000 per depositor, per institution. Uninsured amounts can face temporary restrictions or haircuts while restructuring occurs.

The goal: stabilize the institution and the broader system.

Individual access comes second.

That's not theory. It's published guidance, tested in past episodes.

When news breaks - sudden liquidity squeezes, asset quality drops - reactions tend to cluster.

The crowd moves late.

Signals Institutional Capital Tracks

Smart money reads directional risks, not just current headlines.

Ongoing fiscal deficits. Inflation dynamics that could reaccelerate. Dollar hedging demand from global players.

Gold trading near record levels - pushing past previous highs in December - reflects those flows.

Central banks continue heavy accumulation. Institutional allocations rise quietly.

Tech megacaps provide market leadership through AI productivity, masking some traditional sector weakness.

Banking stocks lag in comparison - rate-sensitive, operationally complex, legacy exposure.

The divergence drives rotation.

When trust in fractional systems gets periodic reminders, capital seeks alternatives outside daily counterparty risk.

More on the practical side in part two.

But the pattern holds.

Structures built on leverage and confidence carry embedded vulnerabilities.

Preparation beats reaction.

🐳 Physical Gold Allocation: The Move Outside Fractional Banking Risk

Gold closed December 23, 2025, trading firmly near all-time highs - another confirmation of ongoing safe-haven demand.

Not retail speculation driving it. Central bank purchases remain robust. Institutional desks add exposure methodically.

The banking sector backdrop provides part of the catalyst.

Why Direct Physical Ownership Appeals Now

Unrealized losses are manageable in calm markets.

In stress, they constrain options quickly.

Resolution processes protect the system - insured deposits first, uninsured subject to potential delays or adjustments.

Removing counterparty exposure entirely changes the equation.

Physical gold in allocated, audited depositories offers direct title. No fractional reserve layer. Secure custody without daily banking risk.

Eligible retirement accounts can roll over tax-deferred - maintaining structure while shifting underlying asset.

Pricing and supply dynamics tighten during surges. Early positioning avoids premium spikes.

Macro Drivers Keeping Gold Elevated

Fiscal paths stay expansive.

Deficits project multi-trillion annually. Monetary policy faces reacceleration risks if growth or spending surprises.

Real yields and currency considerations favor hard assets.

2025 performance - repeated record breaks - validates the hedge.

Tech leadership masks broader unevenness.

AI infrastructure spend boosts select names, but traditional finance grapples with rate cycles, regulatory capital, operational complexity.

The split encourages diversification beyond correlated systems.

What Institutional Flows Signal

Whales prepare for tails, not base cases.

Modest hard-asset allocation costs little when competing yields exist.

But delivers optionality when confidence tests arrive.

Recent reminders - CRE workout increases, isolated liquidity events - nudge incremental moves.

No panic. Just prudent adjustment.

Gold's steady climb rewards the approach.

Practical Takeaway Entering 2026

Q4 data will show further loss digestion, margin stabilization.

Yet the framework endures.

Interest rate paths uncertain. Depositor behavior sensitive. Resolution priorities fixed.

Capital anticipates.

Direct physical allocation - secure, outside routine banking channels - fits current signals.

Not replacement. Complement.

When records keep resetting higher, the rotation speaks for itself.

Position ahead. Let headlines catch up.

The water stays deep - better to navigate clear-eyed.

What topics are you interested in the most?

|

Sponsored Content

Top Picks from Partners We Trust

|

|

Stay ahead of the current - subscribe free

Subscribe to Whales Investing

|